Articles & Videos

Pet Industry on a ‘Pawsitive’ Streak

Pets became priority again during the pandemic with owners forced to stay home to work and fill the void created by isolation with a furry friend instead. 18% of Canadian and 14% of US households surveyed, reported getting a new pet during the pandemic. For those with existing pets, owners also spent much more than previous on looking after them, trying out more premium grooming products and niche new pet foods; all of this was music to the ears for the North American pet industry which grew from $103bn in 2020 to over $130 billion in 2021, with the US recording its highest ever growth according to ‘PetFoodIndustry.com’.

What are the trends driving growth opportunities?

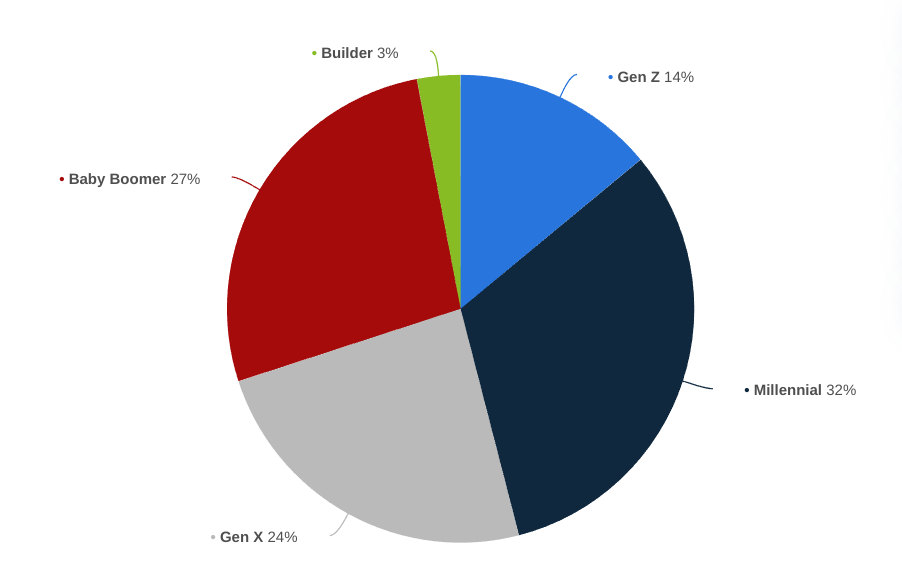

With all the trends that are generating new opportunities for business owners in this sector, it’s worth bearing in mind that the biggest group of pet owners now fall within a younger age group; Millennials make up 32% of pet owners in the US and this will be a big consideration when growing or starting a new business in terms of marketing effectively to the younger demographic.

Source: Statista.com. Accessed: 08.06.2022

Natural and Organic Pet Food & Treats

Typically the biggest share of spend in the pet industry is on pet food and treats. The market has moved way beyond wet or dry food and consumers are interested in pet foods that have minimal ingredients, are all-natural or cover some sort of dietary requirement. Just as natural food proponents for humans extol the benefits of a few, simple, wholesome ingredients, pet food manufacturers are doing the same, introducing a ‘natural’ line of products or bringing new products to market. Fresh pet food and raw diets are also having their heyday as consumers want to feed their pets the most natural products they can find, almost returning to a time before domestication when they would eat whatever they could find.

There’s also been much debate about the packing out of pet foods with grains and animal by-products which consumers have been wary about for some time and are now starting to investigate exactly what’s in their pet food and how it benefits the animal. Similar to humans, pets can often have an aversion to some products too – processed ingredients and artificial flavors and colors can cause nasty reactions for pets including severe itching, gastrointestinal issues and chronic paw and ear infections according to Pets Web MD.

Premium Grooming Products

Part of the pet care segment, premium, natural grooming products are on the up. Shampoos, moisturizers and lotions and premium combs and clippers are all growing in popularity as owners try and pamper their pets at home without the cost of going to a groomer or pet spa.

Some of the established brands on the market are introducing shampoos and cleaners, even ‘wipes’ for pets that include some of those ingredients you might commonly see in human toiletries, for example, micellar water, essential oils and vanilla bean. Many brands that have so far only catered to humans by way of sunscreen and skin care are also venturing into the pet market to expand their business.

Humanization

Both in terms of pet clothing and gifts for occasions such as birthdays, valentines, halloween and Christmas, pet parents are splashing out on making their pets feel as much a part of the family as any human is. A growing part of the pet market, this trend will continue and we’re sure to see more and more doggy birthday cakes, seasonal outfits and more fun stuff in stores.

Sustainability

A trend that dominates all the other trends, sustainability is a huge driver for pet industry consumers, particularly the millennials and Gen-Zs among them who prioritize sustainable products above all else. It’s not enough to have a ‘natural’ range if the brand is inherently environmentally-unfriendly with regards to their policies, ingredients and packaging.

In many ways, pet owners have many of the same concerns as humans over the components in their food; where does the protein come from, was it raised ethically and humanely, how much pollution is being generated through the supply chain and so on. Brands will need to take heed of the consumer’s savviness in searching out information on what processes are used to get to the end product as over 70% of GenZ consumers are willing to pay more for sustainable products according to PetPedia.

What are the Considerations for New Businesses in the Pet Industry?

To coin a pun, the pet industry is a real ‘dog-eat-dog’ market. There are a few massive global players that dominate and their power and reach can seem insurmountable. On the plus side for entrepreneurs however, the way in which consumers shop for pet products is changing, providing new opportunities for brands whose artisanal products fit better with specialist independent retailers, dedicated to customized pet care and service in stores.

Although big-box retailers and grocery stores are threatening traditional brick and mortar stores, we believe the omni-channel retail approach will prevail to offer consumers a choice of buying options but with specialist advice and services tailored to pets as needed.

The industry is not without challenges caused by economic conditions either. Aside from supply chain considerations around equipment and processing plus labor shortages, new companies will be all too aware of the rising cost of living which may affect consumer demand in the near-term; furthermore the costs of doing business are on the increase as policies are implemented to tame inflation so profitability will rely on a watertight strategy. Entrepreneurs will have to fight for their place in this market but the rewards are there for the persistent.

Pet Industry Poised for Growth

The trends are clear – sometimes pet parents are prioritizing premium care and the health and wellness of their pets ahead of their own and splurging on new premium products will continue for the foreseeable. The global pet industry is set to grow at a CAGR of 6.1% between 2022 and 2027, representing $350 billion in sales.

As work-from-home continues to be the norm for most people, we expect the pet industry to carry on growing, providing opportunities for pet entrepreneurs to enter the market with innovative and natural products that keep the furriest members of the family happy.

Opportunities are plenty for entrepreneurs in this sector, it can however be difficult to finance the expansion of a new or rapidly growing business in a market dominated by a few key players and with complex manufacturing and logistical needs. If you need more information on the flexible finance options available to you, don’t hesitate to reach out to our experienced team.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Understanding Accounts Receivable Turnover Ratio for Business

Accounts receivable turnover ratio, also known as debtor turnover ratio, is an accounting measure used to calculate how efficient a…

Read MoreIs US Manufacturing the Route to Economic Recovery?

There’s a big sea change underway in US manufacturing, the start of which predates the significant economic and political events…

Read MoreVideos

The Most Financial Time of the Year

Sallyport commercial finance’s Annual Holiday Music Video!

View NowAG Machining Client Testimonial

AG Machining Client Testimonial

View Now