Articles & Videos

Electric Vehicle Market Rich with Business Opportunity

The electric vehicle is nothing new, surprisingly in fact the very first concepts of electric transportation came about over a century ago; it just happens that they were way ahead of their time back then.

The gas-guzzling vehicles that we’re all now familiar with, started gaining traction at the turn of the century as consumer spending power increased and advances in technology meant that they became more convenient and accessible to the masses. They were also more affordable than their electric counterparts and so the early success of the electric vehicle gave way to a long period of dormancy for the market; at that point it was only the visionaries that would have predicted a comeback for battery-powered vehicles.

Fast forward over a hundred years and it looks like electric vehicles are indeed about to have their long awaited day in the sun – welcome news for entrepreneurs and business owners in the EV space.

Is the Electric Vehicle (EV) Market Growing Right Now?

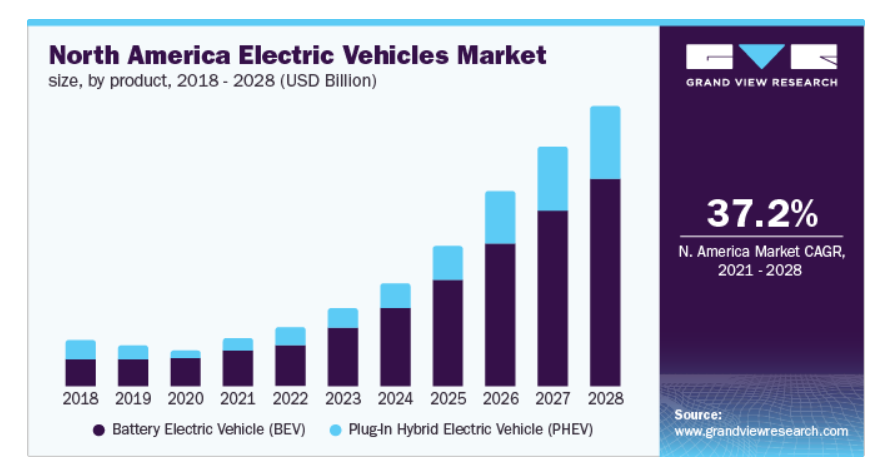

The market is taking off in a big way in North America and globally. Following the ‘blip’ in growth due to the pandemic in 2020, the North American EV market is forecast to grow at a CAGR of 37.2% between 2021 – 2028 and globally at a rate of 17.75% according to Statista.

Source: Grandviewresearch.com. Accessed: 14.11.2022.

Despite supply chain challenges persisting, consumers are clambering to get on wait lists and secure their first EV and manufacturers are trying desperately to keep up with demand but what is it that’s enticing consumers to make the change from gas to either full EV or hybrid vehicle?

The Driving Forces Behind EV Demand

There are several reasons why manufacturers are enjoying accelerated demand for their vehicles, many of which seem to be coming together at the same time…

Gas price inflation

Crude oil prices have always been volatile and we’ve all felt a pinch at the pump at certain times but it feels like this time it’s a bit different. Gas prices in the US hit over $5 a gallon in June 2022, a level which wasn’t even seen during the turbulence of the 2008 financial crisis. Rather than being apathetic to the growing cost of car ownership, consumers recognize that it’s one element of rising living costs; and the biggest monthly outgoing after a mortgage for many, that they can regain control of somewhat. As people have also experienced changes in personal circumstances post-pandemic, electric vehicles are becoming more and more appealing to them.

Gas price inflation in the US was at 17.5% in October 2022 year on year (YoY) and in Canada that figure was up a staggering 48% YoY as of June 2022 – sobering figures and no surprise then that car owners are reassessing the options available to them.

Expediting towards net zero

The US was the second biggest emitter of Co2 in 2020 with the transportation sector making up 27% of those emissions. More stringent greenhouse-gas emission targets set by the US, G7 member countries and other governments worldwide are forcing automotive manufacturers to expedite the development and production of electric vehicles or risk being left behind.

Consumers are coming to the realization that an EV may be the only choice they have in the not-so-distant future and are reconsidering how they get around. As more and more advances are made to the technology on offer, the rate of adoption will no doubt gain pace.

To remain on target for net zero by 2050, electric vehicles must represent 60% of total car sales globally by 2030.

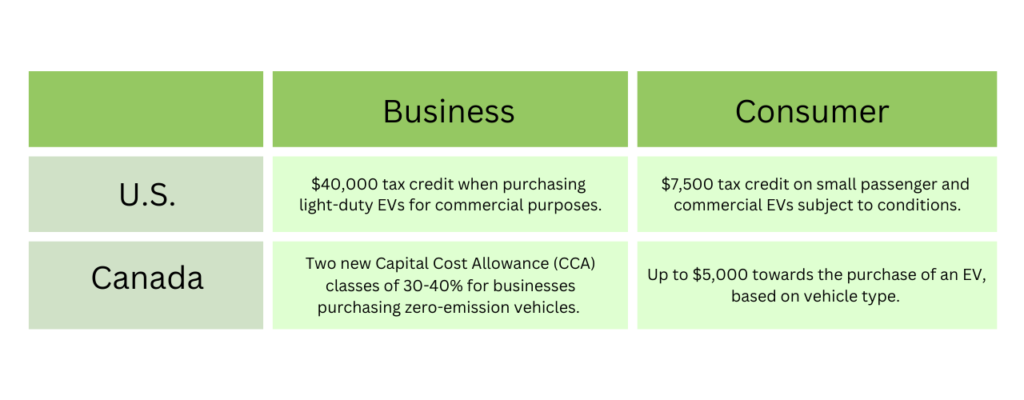

Government incentives

Although EVs have less components, those components cost more which means electric vehicles are typically four or five times more expensive to purchase or lease than gas-powered cars. This cost differential is diminishing as supply chain problems ease and to further encourage early adoption, many governments are instating financial incentives for both businesses and consumers which reduce the upfront cost of obtaining an EV, minimize the tax burden or similar.

Technological advances

The majority of electric vehicles are powered by lithium-ion batteries which have typically been expensive to produce and during the pandemic, production was hampered, not just by the lack of lithium making it to manufacturers but also the lack of other components such as semiconductor chips.

Three countries; Australia, Chile and China are responsible for 90% of all lithium production in the world. The pandemic highlighted the fragility of such reliance on other countries’ for raw materials and startups have been quick off the blocks, coming up with alternatives to lithium powered batteries but also investigating opportunities for lithium mining domestically. There are 2.9 million tonnes of lithium resources in Canada yet when production restarts at La Corne, Quebec in early 2023, it will be one of the only functional lithium concentrate mines in North America.

What may be more interesting to entrepreneurs however, is the potential for technology that could do away with lithium-ion batteries altogether. Environmental opponents argue that mining lithium is simply shifting from one kind of pollution to another and if everyone was to own an electric car, this is equally unsustainable as it comes with wide-ranging ramifications for water supplies and unending questions as to what will happen with the mountains of electrical waste from the batteries themselves.

EV Industry Opportunities are Wide Ranging

Whilst there are challenges with the ramp-up to full electrification, finding the solutions presents extensive opportunities for entrepreneurs everywhere.

Savvy startups are already at work finding alternatives to power the transport of the future, not limited to hydrogen fuel cell powered vehicles, solar powered cars, seawater and powered roads. Essentially, anything that increases EV range and can be produced on a mass scale so as to take cost out of production (without negative environmental impact) will be of interest to aspiring business owners in this sector.

It’s not simply the electric vehicle market itself that requires consideration either; there are a huge amount of related industries, many of which will be new and originate from the need for consumers and businesses to electrify their lives. In the US, the infrastructure deal outlines how they plan to invest billions into updating outdated infrastructure in a bid to reduce carbon emissions. These investments include updated EV charging infrastructure and upgrading power infrastructure so that the electrical grid can cope with the increased amount of EVs connected to it.

Forward-thinking companies, new and existing, will be needed to act on these updates. Other emerging sectors as EV adoption grows will be batteries, refurbished batteries, new battery tech and battery storage infrastructure to connect to the grid. Increasing the amount of charging infrastructure across North America will also be key in allaying consumer fears and ‘range anxiety’. Then there’s advances in the cars themselves in regards to new software for safety and autonomy. The installation of ultrafast chargers by employers and institutions will prove a value-add for these organizations and commercial building owners looking to attract tenants.

The implications of EV adoption for tech businesses are far-reaching and there are a multitude of opportunities for those wanting to start and grow businesses in this sector. We haven’t even scratched the surface of the market opportunity when you consider the other electric vehicles that are at last having their day – eBikes, scooters, trains, buses and other commercial vehicles all present their own unique opportunities for products and services that are not yet available. It’s an exciting time to be part of the growth in the EV market!

If you’d like to understand your options for business financing as a fairly new business or without access to traditional funding, please reach out to the Sallyport team today.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Could Trade Credit Insurance Save Your Business?

Trade credit insurance or accounts receivable insurance is a type of corporate insurance policy within the Property and Casualty business…

Read MorePrint Industry Pushed To Limits

In many industries stock constraints have begun to ease over recent weeks. Fears over virus cases and transmission seem finally…

Read MoreVideos

AG Machining Client Testimonial

AG Machining Client Testimonial

View NowWhat is Factoring?

Here we explain what exactly factoring is and how we can help your cash flow…

View Now