Articles & Videos

Disclosure Laws Incoming – Commercial Lenders Prepare to Comply

Many U.S. states have either already introduced commercial lending disclosure laws or are in the process of passing new legislation. These new laws are requiring commercial lenders to make consumer-type disclosures to borrowers in commercial lending transactions; unless they are exempt through their status as a provider or the loan type being offered.

The primary driver for these regulations is to create a standardized set of disclosures in small business lending, so that borrowers are more easily able to compare the terms from a number of different commercial lenders, prior to committing to a loan or other funding.

Which States have Introduced Disclosure Laws So Far?

California was the first state to enact Commercial Financing Disclosure Laws (CFDLs), bringing them into effect on December 9, 2022. Non-regulated Californian commercial financing providers (CFPs) offering loans, open-end credit plans, lease financing, factoring, sales-based finance (merchant cash advances for example) and asset-based lending transactions are all now subject to compliance for any loan not exceeding $500,000. CFPs exempt from the California disclosure law include credit unions, trust companies, savings and loan associations and federal-and state-chartered banks.

New York state started work on their new legislation back in 2020 and the final regulation was adopted by the New York Department of Financial Services on February 1, 2023, for which compliance becomes mandatory after August 1, 2023. The new law applies to non-bank commercial lenders that provide small business loans of up to $2.5 million. There will be some exemptions for lenders that fall into certain categories;

- Federally regulated financial institutions including banks, savings and loan companies and credit unions authorized to transact in New York;

- Subsidiaries of financial institutions;

- Lenders regulated under the federal Farm Credit Act;

- Lenders who make no more than five commercial finance transactions in New York in a 12-month period.

Following the lead of California and New York, Utah became the third state to pass new commercial lending disclosure requirements for the making of commercial loans over $1 million by non-bank commercial lenders, although factoring companies have so far been exempted from the new law there. Utah law applies to any provider of commercial loans made on or after January 1, 2023 and who closes more than five transactions in the state in a given calendar year. The law does not apply to transactions of more than $1 million, depository institutions and their subsidiaries, federally-regulated entities, licensed money transmitters, commercial financing transactions that are secured by property, purchase money obligations, open-ended loans of more than $50,000 to an auto-rental or motor dealer; or loans that are in some way connected with the sale of a product or service that the company or their affiliate manufactures, distributes or licenses.

Virginia also quietly introduced a new disclosure law specific to merchant cash advance funders and their brokers. Financial entities in Virginia will be subject to the new requirements if they are extending less than $500,000 of sales-based credit to customers or if they enter into more than 5 transactions each year. There are other registration and disclosure requirements as outlined by Ballard Spahr LLP here.

Other states actively discussing new commercial disclosure laws are Connecticut, New Jersey, North Carolina, Missouri, Mississippi and Maryland, where the senate passed new law just last month. This creates further consideration for lenders operating in these states in the months and years to come.

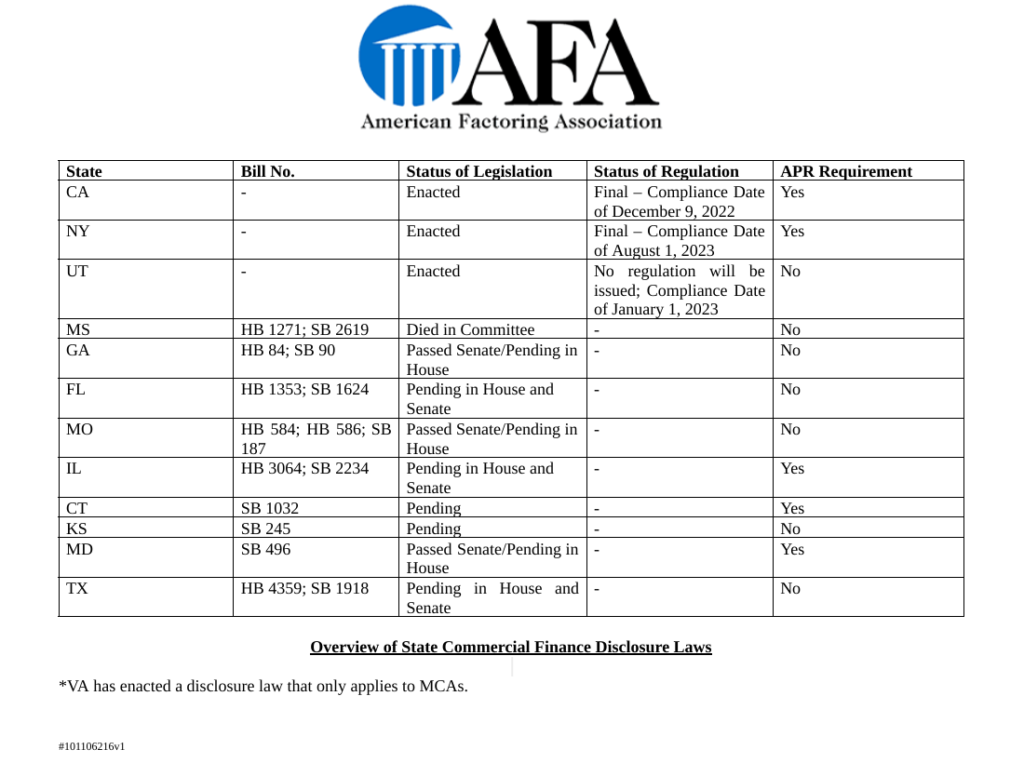

Source: American Factoring Association.

What do the Raft of New Disclosure Laws Mean for Lenders?

We’ve only covered a brief overview of the first states to bring in disclosure laws but the legislation has been passed relatively quickly and there are already a number of questions and complexities for every lender to unpick.

One of the fundamental changes for lenders is the operational change that will be required in sending out disclosures to borrowers at the same time as an offer goes out. Many lenders will not be set up for this change and it may not be particularly easy to put in place new systems and procedures to accommodate.

Perhaps more concerning for many will be that although the new laws are supposed to standardize the information presented to borrowers around the terms of a loan, for lenders, the early signs suggest requirements are anything but standardized for them. The forms that they’re required to complete can vary depending on the type of loan, the state of origin and even the state where the business activity happens. Which laws apply if equipment finance is extended to a business from a finance company in California but the equipment is delivered into Oregon? Which law prevails and how do they ensure compliance? These are important questions to be resolved for both lender and borrower but it’s very early days and there seems many more questions than answers currently. Although New York is attempting to address the challenge of conflicting laws, California has not yet broached it. In the worst case scenario, lenders could be expected to comply with 50 different laws and sets of requirements.

It’s clear that new disclosure laws will mean a bigger burden on small business lenders but as for the extent of this burden only time will tell. On the one hand the market could become more competitive for lenders and open up further funding options for businesses in the market for specialty finance, but conversely and more likely, many lenders may find adherence to the new laws just too onerous and exit the market completely. The Secured Finance Network (SFNet) conducted a poll in March and the responses were concerning; the results showed that since the new California disclosure rules were implemented in December 2022, 40% of respondents were found to be ‘no longer lending’ to prospective borrowers who fall within the regulatory threshold of less than $500,000.

If this survey signals what’s to come for small businesses in other states, the new disclosure laws will have achieved the exact opposite of what they were supposed to, in making access to finance more accessible for small businesses already grappling with cash flow difficulties.

New Disclosure Laws to Weed Out ‘Predatory’ Lenders

It’s widely thought that the marauding nature of some merchant cash advance lenders placed the new disclosure laws at the front of mind for state legislators. Both state and federal legislators are in consensus that small businesses need some protection from the government against lenders that prey on small businesses’ misfortune with unfair and unsustainable loans.

No reputable finance company will argue against trying to protect small business borrowers from predatory lenders. Like Sallyport, those genuinely invested in their clients’ success, can and will jump through the many new ‘hoops’ to continue servicing SMEs with the finance solutions they need to grow sustainably.

The new laws are coming thick and fast and commercial finance providers should consult a qualified in-state legal professional for advice on the specifics of their own compliance. It would be pertinent to do this sooner rather than later given that more states have new laws in the pipeline which we could see materializing before the end of 2023.

Sallyport remains committed to serving businesses across North America with tailored financial solutions and is fully compliant with the new lending laws enacted in California, New York and Utah. Reach out for no-obligation guidance through any cash flow challenges you might be experiencing and the financial solutions open to you.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Harnessing Growth Opportunities in the Beauty Industry

The beauty industry is big business and it’s getting even bigger. Globally, sales reached $511B in 2021 and are estimated…

Read MoreTop 10 Ways to Improve Performance in Food and Beverage Manufacturing

There’s no doubt, being in the food and beverage manufacturing industry at this point in time is tough. It was…

Read MoreVideos

What is Factoring?

Here we explain what exactly factoring is and how we can help your cash flow…

View Now