Articles & Videos

Changes to SBA 7(a) Loan Fees – What you Need to Know

The U.S. Small Business Administration (SBA) has recently completed its annual review of the fees that it charges lenders under the 7(a) small business loan program.

This process sets out the fees that a lender must pay under the SBA program for all loans approved in the upcoming fiscal year. The latest information notice (5000-848801) confirms that these new fees will become effective on October 1, 2023.

Many borrowers may be unaware of the specific terms and conditions of their loan agreements including the fees that SBA lenders are entitled to pass onto them.

What Fees are Payable by a Lender on an SBA 7(a) Loan?

There are two main fees that lenders must pay the SBA on a 7(a) loan;

- A Lender’s Annual Service Fee, also called the SBA On-going Guaranty Fee is a fee based on the outstanding principal balance amount on the guaranteed portion of a 7(a) loan at the time of SBA approval. Lenders are not permitted to pass this fee onto borrowers.

- An Upfront Fee, called an SBA Guaranty Fee is payable to the SBA for every loan guaranteed under the program; lenders are however allowed to pass the cost of the Upfront Fee on to the borrower.

What are the SBA Loan Fee Changes?

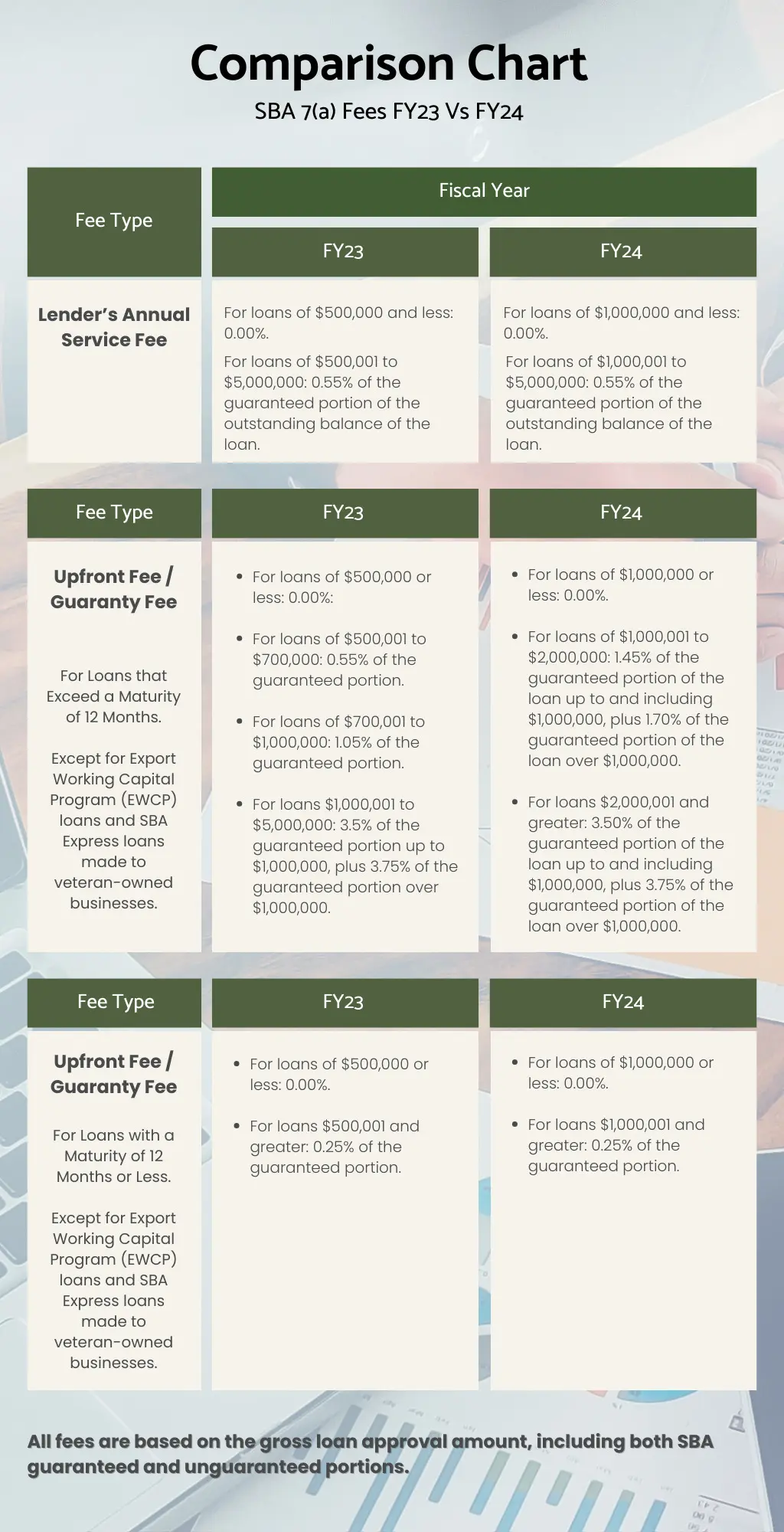

New fees will apply for any loans approved from October 1st, 2023, through to and including September 30th, 2024 (the Fiscal Year 2024) as follows;

Exceptions and Other Things to Know About the SBA 7(a) Loan Fee Changes

There are a number of other scenarios outlined in the latest SBA update that may impact your particular situation and the fees charged by your lender; when you’re extending an existing loan for example and borrowers should be fully informed of these thresholds.

Upfront Fees

Extending an SBA 7(a) Short-term Loan

- An additional Upfront Fee is due when the maturity of a short-term loan is extended beyond 12 months.

- An additional Upfront Fee is due when an Export Working Capital Program (EWCP) loan greater than $1M with an original maturity of 24 months or less is extended beyond the original maturity date, up to the maximum period of 36 months.

- Additional fees have to be paid electronically to SBA within 30 days of the date that a lender agrees to an extension, otherwise the total loan guaranty will be canceled.

- The additional Upfront Fee may be charged to the borrower after the lender has paid the additional fee and notified SBA that the maturity has been extended.

90-day Rule for Multiple SBA 7(A) Loans

- When two or more loans (each exceeding 12-months maturity) are approved within 90 days of one another, the loans will be considered as one loan when determining the Upfront Fee calculation and the percentage of the guaranty. This rule applies no matter whether the loans are approved by the same or different lenders. The 90-day rule does not apply to the application of the Annual Service Fee which will be set for each loan on an individual basis (loans won’t be aggregated in this situation).

- The Upfront Fee will never be a negative amount – the fee for subsequent loans will be equal to the amount that would have been charged, had the loans been combined, less any fee that was paid or us due to be paid on the original loan approved.

- Lenders cannot split loans for the purpose of avoiding fees.

Upfront Fees on ECWP Loans

- For EWCP loans of $1,000,000 or less (regardless of maturity): the Upfront Fee is 0.00%. In FY2023, the 0% fee applied to loans up to $500,000.

- For an EWCP loan greater than $1,000,000 with a maturity of 12 months or less: the Upfront Fee is 0.25% of the guaranteed portion. In FY23, EWCP loans greater than $500,000 with a maturity of 12 months or less, would have attracted an Upfront Fee of 0.25% of the guaranteed portion.

- For EWCP loans greater than $1,000,000 with a maturity of 13 up to 24 months: the Upfront Fee is 0.525% of the guaranteed portion. Based on the same maturity of 13-24 months, the 0.535% fee would have applied to loans greater than $500,000 last fiscal year.

- For EWCP loans greater than $1,000,000 with a maturity of 25 up to 36 months: the Upfront Fee is 0.80% of the guaranteed portion. This threshold would have been $500,000 in FY2023.

Annual Service Fees

Whilst this fee cannot be passed on to borrowers, the Lender’s Annual Service Fee on a loan is calculated based on the guaranteed portion of the outstanding loan balance, according to the fee schedule in effect at the time the loan was approved. When a loan is increased the Annual Service Fee will be recalculated based on the revised loan amount and lenders will be obligated to pay this.

Staying on Top of Changes

Should they meet all the eligibility requirements, the SBA 7(a) loan program offers small businesses access to a diverse range of lenders for their financial needs, however it won’t be the best fit for every business. The availability and terms of SBA loans can fluctuate frequently so it’s crucial for business owners to carefully assess their needs and compare different loan options to determine which one is most suitable for their situation.

With any financial agreement. It’s important to understand all your obligations and the specific terms and conditions before entering into a contract. If you’re unsure if or how this latest update impacts you, reach out to your local SBA district office for advice.

Our team is always here to answer any commercial funding questions you may have and help you research the finance options available to you. Reach out today.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Labor Market Shortages Stifling SME Growth

Since the U.S. has started to resume business-as-normal there’s been talk of a labor market shortage emerging and creating a…

Read MoreHow Do Businesses Benefit from a Cash Flow Loan?

Businesses experience cash flow challenges for a number of reasons. These problems are not all bad news; a company may…

Read MoreVideos

AG Machining Client Testimonial

AG Machining Client Testimonial

View Now