Articles & Videos

Can You Get a Business Loan with Bad Credit?

Good credit management is one of those things that you only value when you really need it. When it comes to securing finance to grow a business, getting a small business loan may not be as straightforward as you’d hoped if you’ve neglected to keep an eye on your credit score and bad credit control has left blemishes on your report. Getting a loan to fund a new business idea can be equally as frustrating because lack of credit history can be as much of a red flag as bad credit history in the eyes of a conventional lender.

What is ‘Bad’ Business Credit?

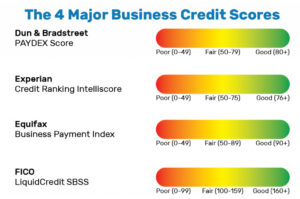

When a business is referred to as having ‘bad credit’, we’re referring to their credit score. A business credit score can differ depending on which credit scoring agency is used and each agency may have several different types of risk score they can provide. Lenders may utilize a combination of reports to build a picture of the business, it’s management and financial health. There are three main business credit scoring agencies;

- Dun and Bradstreet (D&B);

- Experian, and;

- Equifax.

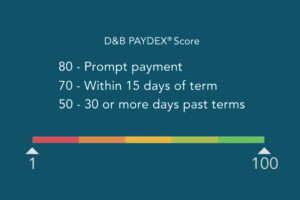

D&B is probably the most commonly used in North America, utilizing something called a ‘Paydex Score’ to represent the business’ past payment performance and in Canada, TransUnion is also a popular reporting tool.

Source: DNB.COM. Accessed: 02.02.2022.

Outside of these agencies, you may also have heard of something called FICO SBSS (Small Business Scoring Service) which is not a credit agency as such but provides a measurement of creditworthiness specific to small business. The FICO SBSS score combines your personal and business credit score into a measure between 0-300 to assess the probability of being able to pay back a loan and is used by the US Small Business Administration (SBA) in pre-screening loan applicants.

Source: FitSmallBusiness.com. Accessed: 02.02.2022.

A business credit score of 75 or above will usually open doors to bank and SBA loans at the lowest interest rates with very favorable repayment terms, however anything under 30 would likely signify some significant undesirable credit issues and could lock you out of the most attractive financial solutions on the market.

In theory, a score of less than 30 might be deemed as having bad credit but in practice it’s rarely that simple. Even a business with a score of 75 plus may struggle obtaining a loan from a commercial bank if they can’t show any revenue or demonstrate a sound business plan and likewise a weaker score of 30 won’t necessarily exclude you from a business loan if the reasons for the bad credit are not due to mis-management and the business has healthy growth projections. A business with collateral in the form of accounts receivable or assets will also have improved chances of qualifying so as you can see, there are many variables involved.

Will Personal Credit Score Affect a Business Loan Application?

Business credit score is a separate measurement to a personal credit score which runs on a scale of 300-900, however they are also completely interlinked. For businesses without enough history for a business credit score or with a poor payment history, lenders will often revert to personal credit scores to determine creditworthiness.

Both business and personal credit scores have an impact on how potential investors, partners and lenders view your business’ financial risk and can also affect your ability to secure the best rates on loans and insurances, get credit terms from suppliers and much more. For these reasons, implementing good credit management strategies and tracking is imperative to a company’s success or failure.

Understandably, keeping a handle on credit scores is time consuming and can easily be pushed down the priority list for busy business owners, particularly during the last couple of years. Fortunately there are ways to start improving your business credit score for the future and many alternative lenders have teams in place to support you in doing just that.

If it’s not too late to start working on it, there are a few strategies that you can implement to improve your business’ credit score…

- Reducing credit utilization – most lenders will look for no more than 30% of your total credit to be used, but between 20-30% is ideal;

- Make sure you make debt repayments on time and communicate with creditors when you’re not able to;

- Establish lines of credit with a few suppliers that report payment information to the credit agencies to build your profile;

- Avoid making applications for lots of different credit if there’s little chance of being approved;

- Apply for an Employer Identification Number (EIN) in the US or a Business Number (BN) in Canada. These unique IDs allow your business to be effectively tracked by the credit bureaus.

What are the Options if you need Finance Now?

‘No credit check’ financial solutions do exist, however they are few and far between, come with excessive interest rates and fees and typically only serve to worsen a company’s financial situation. High-interest debt finance such as credit cards and merchant cash advance should rarely be used as a long-term solution where there are other options available.

There’s no need to abandon your dream of expanding your business either if your credit score is on the poorer side. Rest assured, there are options no matter the situation. Credit score is just one way to assess a businesses potential to repay a loan and while it’s fair to say banks may be reluctant to fund too many businesses at the lower thresholds and prefer to see a few years worth of credit history, there are alternative lenders who take a more holistic view of your business when making their decision.

You will likely still be able to get a loan or a combination of finance from an alternative lender at favorable terms if they can see that you’ve personally got the passion and potential to succeed.

The idea is to use the funding that is available to you to help build or rebuild your credit score and pave the way for more financing options to open up to you in the future.

Sallyport has worked with many business owners recently whose bad credit score might have seen them rejected for bank loans. Our aim is to always do everything in our power to fund a great business and get them back on the right track; funding a business out of bankruptcy is not unheard of either. Reach out today and we’ll talk through all the possible options available for your situation.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

5 Growth Stages of Business and How to Finance Them

It doesn’t matter whether you’re in manufacturing or staffing, have one or fifty employees; the growth stages of business look…

Read MoreWarehousing and Logistics on the Bank Naughty List

In today’s lending landscape, industries are being scrutinized more than ever and some are being painted with a broader brush…

Read MoreVideos

What is Factoring?

Here we explain what exactly factoring is and how we can help your cash flow…

View NowAG Machining Client Testimonial

AG Machining Client Testimonial

View Now