Articles & Videos

Why Do Companies Outsource? Hiring from Outside

Companies who outsource in 2023 are doing it for the very same reasons as companies that were considered early-adopters in the late 1980s. Whilst the reasons for outsourcing remain largely unchanged, attitudes towards it have come full circle.

In the 60s and 70s business models were centered around businesses directly managing and controlling all its own assets and operations, to give anything up to a third-party would have been viewed unfavorably. This led to excess layers in a company, particularly managerial and although this was recognized by some, who started to identify and outsource non-critical operations, this approach would still have been considered unorthodox and risky at that time.

In the 1990s more and more businesses embraced outsourcing for core functions as a means to reduce costs, albeit, still in an ad-hoc way. Following this, businesses started to look at third-parties as more useful, strategic partners with the ability to get results when they weren’t able.

What is Outsourcing / Business Process Outsourcing?

Outsourcing or Business Process Outsourcing to give it its full name is the process by which organizations contract third-parties to undertake job functions or processes or even provide services that the company could ordinarily handle internally.

These third-party service providers are often located in different countries, which may offer cost advantages or specific expertise that the organization doesn’t have itself. Outsourcing allows organizations to focus on their core competencies while delegating non-core or secondary tasks to specialized providers.

Why do Companies Outsource in 2023?

Alongside the change in mindset towards letting third-parties manage their functions, doing business is now also vastly more complex than it was thirty years ago. Most modern businesses simply have to rely on the services of external partners at some point in order to survive. The COVID-19 pandemic meant huge growth for the outsourcing sector as companies scrambled to sustain operations, cut costs and enable remote work. Some industries experienced a massive surge in demand and business process outsourcing (BPO), allowed them to tap into specialized expertise from service providers who could handle the increased workload more efficiently.

More and more businesses will use outsourcing in the coming years to achieve their growth goals without the overheads of setting up additional teams and departments; this flexibility is particularly important to small businesses without the resources of their bigger counterparts and to startups who need to control their expenses and bring products and services to market quickly.

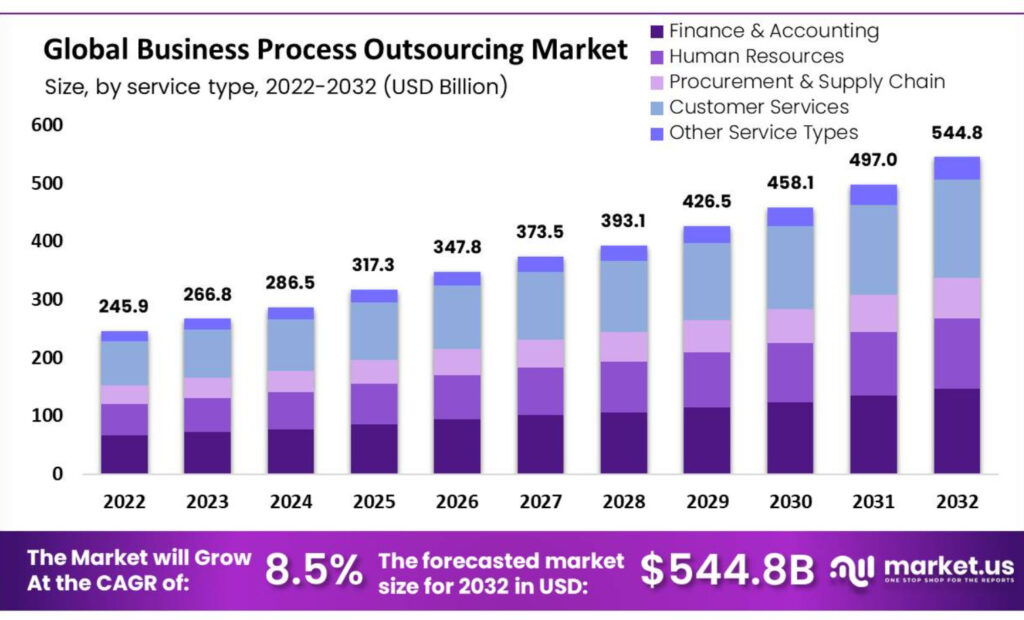

According to Globe Newswire, the global market for outsourcing services will register 8.5% CAGR between 2023-2032 and North America had the largest revenue share of the BPO market in 2022, at 35%.

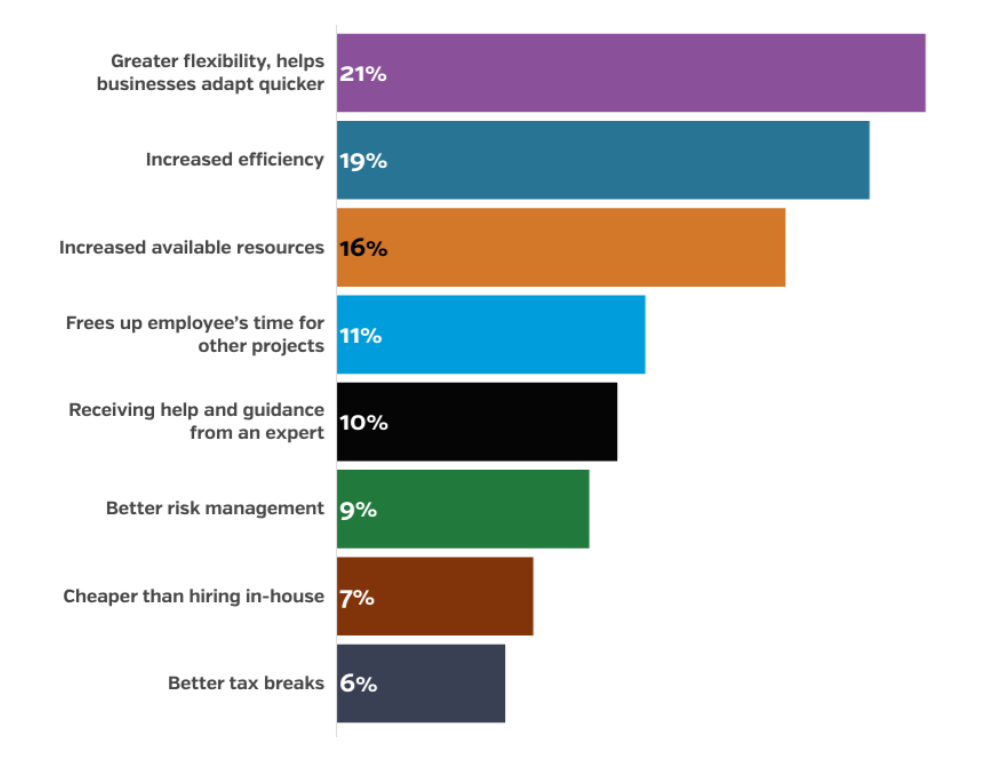

A survey by UpCity in 2022 revealed the biggest benefits that businesses had experienced from outsourcing. Topping the list were greater flexibility and ability to adapt quickly; closely related to this was greater efficiency in second place.

Advances in automation technology and increased cloud computing adoption will continue to fuel the growth of outsourcing services across North America for the foreseeable.

What are the Benefits of Outsourcing for Businesses?

The benefits of outsourcing are numerous and growing just as quickly as the business landscape changes, demanding more agile businesses; able to adapt quickly to economic, social and market trends to maximize their profits.

Some of the key benefits include;

Cost Savings

Outsourcing certain functions to providers that only charge for services used or to countries with lower labor costs can lead to significant cost savings for businesses.

Focus on Core Competencies

By outsourcing non-core activities, companies can redirect their resources and attention to their foundational business functions allowing them to improve efficiency and productivity. This can lead to revenue growth.

Access Specialized Skills

Outsourcing providers often have expertise and experience in very niche areas, enabling companies to access knowledge that they may not have in-house.

Scalability and Flexibility

Outsourcing allows businesses to scale their operations up or down quickly depending on their needs, without the hassle of hiring or dismissing employees.

Competitive Advantage

Using outside organizations can accelerate project work and therefore expedite the time to market giving the business an advantage over the competition. This is particularly pertinent to smaller businesses who may struggle to afford the wages for the most talented candidates.

More Predictable Cash Flow

The cost of servicing employees can be unpredictable faced with uncertain economic and financial policy and changing regulation. When businesses use outside services, they can typically agree fixed costs for work for the duration of a contract, giving them greater certainty over their cash flow.

In today’s landscape, some other benefits of outsourcing have emerged over more recent years…

Leveraging New Technologies

Rapid advancements in technology have opened up new avenues for businesses to outsource. Companies can leverage technologies such as cloud computing, artificial intelligence (AI), robotic process automation and big data analytics through outsourcing partnerships, allowing the to expand their capabilities and drive innovation.

Market Expansion and Globalization

Entering new markets and expanding globally can present a number of regulatory, language and cultural barriers for a business. Using an outsourcing provider located in the region can help businesses enter new markets more efficiently and establish a global presence with reduced risk and cost.

Risk Mitigation and Business Continuity

Through engaging multiple outsourcing partners or geographically dispersed service providers, companies can establish backup and contingency for critical processes, safeguard against disruption and enhance resilience when faced with adverse events.

Accelerated Time to Market

Outsourcing providers with expertise in areas such as product development, software development and supply chain management can help companies to streamline their processes, reduce lead times and bring their offering to market faster. Supply chain management has been well-debated since the chaos of the pandemic as it became clear that some businesses just didn’t have the resources or skills to rectify their challenges; outsourcing can take that stress away, using the comprehensive knowledge of outside specialists to gain an advantage.

What Types of Business Functions Can be Outsourced?

Business process outsourcing can fall into three main groups of processes…

Back-Office Operations

This would include tasks such as data entry, payroll processing, accounting, accounts receivable management, human resources management and other administrative functions that support the internal operations of a business.

Front-Office Operations

These processes involve customer-facing activities such as customer support, tech support, telemarketing, sales and help desk services. These functions are often outsourced when companies need to provide round-the-clock customer service or technical support for example. Knowledge Process Outsourcing (KPO) is the outsourcing of high-level, knowledge-based tasks that require advanced technical and analytical skills. Some examples of this may be scientific research, legal and financial services, market research and data analysis.

I.T. Outsourcing

I.T. has always been one of the main areas that businesses looked to outsource because no matter the capabilities of an internal manager, it’s too broad an area for one person alone. Many businesses rely on outside providers to supply one or all of their I.T. functions such as cybersecurity services, network operations, software development, infrastructure management and application maintenance.

Outsourcing Accounts Receivable Services

Utilizing a factoring company to handle your accounts receivable services is just one example of outsourcing back-office operations and freeing up time to build the business. Although the primary purpose for using accounts receivable services is to fill a gap in finance when traditional lenders won’t help, factoring companies provide a range of value-added service to their clients. While specific offering will vary between companies, some common tasks that they will undertake are;

- Accounts Receivable Management

Factors will assist in managing the entire accounts receivable process by handling tasks such as invoicing, credit monitoring, collections and tracking payment status. This leaves the business free to concentrate on core operations.

- Credit Risk Assessment

Factoring companies need to have expertise in evaluating the creditworthiness of customers or clients. They employ experienced risk professionals to assess the credit risk associated with their client’s invoices and provide insights and recommendations to them so that they may make informed decisions about extending credit terms or indeed which customers they want to work with.

- Credit Protection

Some factors offer credit protection services through a type of arrangement known as non-recourse factoring. In this arrangement, the factoring company assumes the credit risk associated with the purchased invoices. If the customer fails to pay due to insolvency, the factoring company bears the loss, providing added protection for the client.

- Payment Collection

A factoring company will typically take on the responsibility of collecting payments from customers on behalf of their clients. They employ professional collection practices, which can include follow-up calls, statements and reminders to ensure timely payments and sufficient cash flow for the client.

- Reporting and Analytics

Factoring companies often offer detailed insights into sales patterns, customer payment behaviors and other data that can help businesses better understand their financial performance and make informed decisions.

- Customer Service

The factoring company serves as a point of contact for customers and handles all inquiries related to invoices, payments and account information. By outsourcing customer service, businesses can free up their own resources to focus on more critical aspects of their operation.

- Industry Expertise and Guidance

Accounts receivable businesses often have industry-specific knowledge and experience. They can provide guidance related to credit terms, industry trends and best practices.

For businesses small and large, outsourcing accounts receivable services is the ideal way to keep a handle on cash flow; at the same time the value-added services on offer enable them to treat the factoring company as an extension of their own without having to take on more employees and overhead expenses.

Modern Businesses Lean Heavy on Outsourcing

In summary, outsourcing won’t be suitable for every function of every business, however for many it will allow them to realize several benefits including cost reductions, predictability of cash flow and achieving more agility as they recoup their time to focus on core competencies. Most modern businesses will now need to rely on outsourced functions to thrive and it makes sense for business owners to concentrate on what they do best while letting others focus on their strengths.

If you’re interested in finding out more about our accounts receivable services and how you can use our expertise in managing your debtors, reach out to our team today.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Business Debt Consolidation – Everything You Need to Know

Business debt consolidation does exactly what you might expect; consolidate a number of varying business debts into a new agreement. …

Read More5 Growth Stages of Business and How to Finance Them

It doesn’t matter whether you’re in manufacturing or staffing, have one or fifty employees; the growth stages of business look…

Read MoreVideos