Articles & Videos

Using Staffing Factoring to Overcome Industry Challenges

Staffing factoring essentially refers to invoice factoring when used by a staffing company. Factoring for staffing companies, whilst the specific terms and advances of the arrangement may differ, works just like an invoice factoring transaction would in other industries. The staffing company sells its accounts receivable (unpaid invoices) to a third-party financial company, known as the ‘factor’. The factor then advances a portion of the invoice’s value to the staffing agency, providing immediate cash flow and proceeds to collect the full invoice amount from the debtor.

Staffing factoring is a commonly used form of finance for staffing agencies, allowing them to be paid faster on invoices to customers, avoiding the common 30-90 day wait for payment and enhancing cash flow immediately.

What Industry Challenges might Factoring Help With?

The staffing industry landscape has evolved dramatically over the past few years, accelerated by the pandemic, technology and shifting workforce dynamics. The industry will continue to adapt as the needs of both clients and candidates dictate and new workforce and recruitment trends emerge. Staffing companies must identify the challenges pertinent to them and have a strategy for dealing with them in order to succeed in a dynamic and competitive industry.

We looked at some of the challenges facing staffing agencies as COVID-19 subsided, however it’s worth revisiting what the challenges are now as we edge closer to 2024 and delve into some practical solutions to dealing with them.

Technology and Automation

The amount of new tools available to staffing agencies is overwhelming. From AI and machine learning to blockchain, there’s a new or improved technology to increase operational efficiency in every area of business.

Artificial intelligence can be used for candidate matching and resume screening making the candidate selection process less onerous and predictive analytics enables the forecasting of workforce needs so that agencies can proactively source the right talent. Blockchain tech can help in securely identifying candidate’s qualifications, certifications and work histories for a more efficient screening process. Agencies may need to use learning platforms to offer training and education services to candidates in order to upskill and re-skill workers to meet the changing demands of the job market and ultimately, their clients. There are so many tasks that can be automated or advanced by the use of technology, the difficulty lies in deciding where to invest.

To remain efficient and competitive, agencies need to identify which areas they fall short in, what will allow them the biggest competitive advantage and may need to invest in various technology and automation solutions to stay ahead. These investments can be costly but lead to improved operational efficiency and longer-term savings plus potential additional revenue streams.

Diversity, Equity and Inclusion (DEI)

In 2024, employers will continue to be motivated to find ways to make the hiring process more diverse, equitable and inclusive for all. The challenge for staffing agencies is how they can support their clients in achieving this. This is a complex area, requiring agencies to introduce systems that remove unconscious biases, recognize cultural differences and expand their candidate pool in industries that have been underrepresented historically. A DEI focus is admirable but hiring in this way is only the beginning; organizations then need guidance on retaining and promoting talent fairly and creating an inclusive company culture.

Tackling this challenge starts with the culture of the staffing agency itself; what training do their employees get in diversity and how is an inclusive work environment fostered? After that, the agency can focus on the candidate process and implementing inclusive hiring practices. Investments could be made into technology that enables blind resume screening and agencies will need to develop collaborations and network with organizations that can supply underrepresented candidates such as newcomers and immigrants services. Prioritizing these initiatives will help staffing agencies better serve the DEI needs of their clients, but it’s a process of continuous improvement and will require capital to invest in both human and technological resources.

Economic Uncertainty

The economic landscape is still uncertain and this can result in many financial challenges for staffing agencies. Costs have been on the rise for some time and agencies are likely finding that they’re paying more for payroll, worker’s benefits, office rent and utilities to name a few.

The demand for workers may be decreasing as clients prepare for an economic downturn and profit margins could be diminishing if prices have to be reduced to remain competitive. Furthermore, as recession bites, payments from some clients may be taking much longer to come through. All of these things can weigh heavily on an agency’s cash flow.

There are many ways a business can prepare for a recession and mitigate economic uncertainty. For a staffing agency, making sure you have a back-up plan for alleviating cash flow is vital. Staffing agency factoring or payroll funding as it’s also known is a type of alternative finance that allows agencies to extract the cash tied up in their outstanding invoices before they are paid by clients. Utilizing this service means that agencies can still grow their organizations and meet payroll obligations without worrying about spiraling costs.

Candidate-Driven Market

For the time-being, the staffing industry remains candidate-driven. Talent acquisition solution provider Jobvite says that candidates still feel as though the current job market favors them and they have high expectations from the recruitment process.

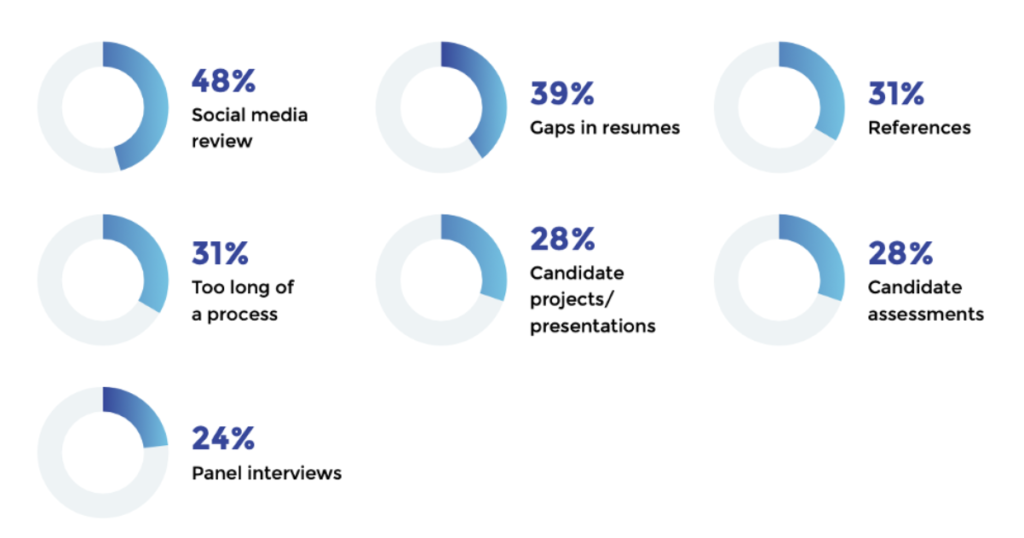

Staffing agencies must support clients in addressing the pain points of potential employees and make sure that the candidate experience of the hiring process is an exceptional one. Some of the areas that job seekers believe should be less of a priority for recruiters are;

In light of this, staffing agencies must aim to create a transparent, positive and communicative process if they are to enhance candidate’s experience and help build a positive brand image for their clients. Some of the strategies that they may use for this are;

- Streamlined application process, the details of which are clear to the candidate from the very start. The staffing agency may use technology to remove unnecessary steps and make the process more efficient;

- Ensure transparency in the process, providing regular feedback and being responsive to candidate’s questions and needs;

- Personalization of communications so that the candidate feels valued and not just ‘another number’. Agencies should take the time to get to know the candidate both professionally and personally so that they can align them with the right opportunity and understanding their interests and goals will ensure the right placement and a better experience;

- Don’t stop after hiring – even after the hiring process, the candidate’s experience can be enhanced through follow-up surveys and onboarding help to ensure a smooth transition into their new role.

Creating a candidate-centric approach has many variables and whilst it presents an ongoing challenge for recruiters, it’s arguably one of the more simple challenges to address with some practical strategies.

Growth of Managed Service Providers (MSPs)

The managed services market has grown massively in recent years and is expected to continue on this trend with 11.9% CAGR forecasted between 2023-2032. The main drivers of this growth may be attributed to the growing complexity of I.T. systems and the desire for companies to reduce their costs through outsourcing.

This growth presents both opportunities and challenges for the staffing industry. Agencies may garner access to a much broader client base, doing so however can be complex. A collaboration with an MSP typically requires adherence to their terms and conditions, legal compliance to labor laws and client-specific regulations and a greater level of flexibility in pricing and service offerings than the business would ordinarily offer.

Whilst working with MSPs could present a huge opportunity, it can cause increased pressure on the working capital of a staffing business. Generally an MSP will work to reduce the costs of their clients and pitch many agencies against each other to drive down prices; this can therefore impact profit margins for the agency. Payment terms may be less favorable through an MSP than dealing with a client directly and agencies may find themselves agreeing to extended terms and discounting just to secure the business. Dealing with an MSPs own systems and processes could also prove a bigger administrative burden for a staffing company.

A staffing agency must carefully consider all the risks and benefits of entering into agreements with MSPs. If it’s a great opportunity for business growth, payroll funding can provide the influx of working capital needed to be able to confidently accept large clients without impacting existing operations.

Factoring for Staffing Companies – A Constant in an Ever-Changing Landscape

The speed of change in the staffing industry can be overwhelming, especially as economic uncertainty looms. Not being able to take advantage of technological advancements or compete for the best candidates are just some ways a business can be left behind. There could also be very lucrative and viable business opportunities that are missed simply because there isn’t enough working capital to support them. On the other hand, investments must be made carefully to ensure financial stability and the continued ability to meet payroll.

Factoring is a flexible and commonly used finance solution which allows staffing companies to exploit the value of their accounts receivable in order to overcome a multitude of challenges, invest in technology or people and stay a step ahead of the competition.

Reach out to our team for more information on invoice factoring for staffing companies.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Destination Madagascar for Apparel Businesses?

Madagascar, the fourth largest island in the world, located off the southeastern coast of Africa, has experienced a period of…

Read MoreWhere to Find Funding for Dropshipping Businesses

Dropshipping can be a very low-cost way to start an e-commerce business. You can think of it as using a…

Read MoreVideos

Popkoffs Client Testimonial

Popkoffs Client Testimonial

View Now