Articles & Videos

UK Businesses Eyeing Global Expansion in 2024

The International Monetary Fund (IMF) predicts resilient global economic growth in 2024 with a 3.1% increase in GDP. Whilst most regions are expected to see positive growth this year, some will certainly be stronger than others and therefore offer a more appealing proposition for UK businesses eyeing global expansion.

Understanding global GDP growth can provide valuable insights into the economic health of disparate countries and regions, allowing businesses to identify international markets with long-term economic stability and the potential demand for their products or services.

Which Countries are the Most Appealing for a UK Business’ Global Expansion?

Whilst UK businesses have understandably concentrated on the European market as a focus for foreign expansion, appetite is growing for opportunities further afield. Unfavorable trading conditions in the UK such as the highest interest rate in over 15 years, spiraling operational costs (energy, raw materials and labor) and the continued regulatory burden following BREXIT are all spurring UK companies to investigate opportunities for expansion on far more distant shores.

In a survey of UK businesses, the Financial Times reported that three-quarters of the respondents believed that their business with the EU had fallen, become less profitable and also vastly more complex as a result of the EU-UK Trade and Cooperation Agreement. 68% of those surveyed said they were actively looking into expansion into non-EU markets, with 45% looking at the US,, 41% Canada, 27% New Zealand and 26% China.

Criteria Businesses can use to Decide which Countries to Invest in

Aside from GDP, businesses must carefully assess various other criteria when deciding which foreign country to invest in. Here’s some of the common elements that businesses can use to determine the suitability and potential of different markets;

- Market Size and Growth: Evaluate the size of the target market in terms of population, GDP and purchasing power parity (PPP). Also, assess the historical and projected growth rates of the market to gauge its potential for expansion.

- Economic Stability: Assess the overall economic stability of the country, including factors such as inflation rates, unemployment levels, currency stability and fiscal policies. Look for countries with a stable macroeconomic environment conducive to business operations.

- Regulatory Environment: Evaluate the regulatory framework governing business activities in the target country, including tax policies, trade regulations, intellectual property protection, labor laws and investment incentives. Choose countries with transparent and business-friendly regulations that facilitate foreign investment.

- Political Stability and Legal System: Consider the political stability of the country and the effectiveness of its legal system in enforcing contracts, resolving disputes and protecting property rights. Political stability reduces the risk of policy changes, social unrest, or government intervention that could disrupt business operations.

- Infrastructure and Logistics: Assess the quality of infrastructure, including transportation networks, telecommunications, energy supply, and internet connectivity. Reliable infrastructure reduces operational costs and facilitates the movement of goods and services within the country and across borders.

- Labor Market: Evaluate the availability and quality of the local workforce, including factors such as education levels, skills, productivity and wage rates. Consider labor market regulations, labor mobility and the ease of hiring and retaining employees.

- Market Access and Trade Agreements: Consider the country’s trade agreements, tariff barriers, and import/export regulations. Evaluate the ease of market access for foreign goods and services and assess the potential impact of trade agreements on your business’s competitiveness.

- Cultural and Social Factors: Understand the cultural norms, consumer preferences and social trends in the target country. Consider cultural differences, language barriers and the potential need for localization in marketing, product adaptation and customer service.

- Competitive Landscape: Analyze the competitive environment within the target market, including the presence of local competitors, multinational corporations and potential barriers to entry. Assess your business’s competitive advantage and positioning relative to existing players in the market.

- Risk Assessment: Identify and assess potential risks associated with investing in the target country, including political, economic, legal, operational and environmental risks. Develop risk mitigation strategies to minimize exposure to potential threats and uncertainties.

- Technology and Innovation: Consider the level of technological adoption, innovation ecosystem, and digital infrastructure in the target country. Evaluate opportunities for leveraging technology to enhance business operations, reach new customers and drive competitive advantage.

- Sustainability and Corporate Social Responsibility (CSR): Assess the country’s commitment to sustainability, environmental protection and CSR practices. Consider the reputational and ethical implications of operating in the target market and align your business values with local expectations.

Conducting thorough market research, seeking expert advice, and adapting your strategy to the specific characteristics of each target market will set a firm foundation for global expansion.

Why is North America the First Choice for Non-EU Expansion?

Considering the above criteria, North America, particularly the United States, is a popular destination for UK businesses looking to expand internationally. The US boasts a large population of over 341 million and offers a huge and diverse pool of consumers with significant disposable income.

The US is largely a business-friendly environment with the vast majority of industries welcoming to foreign-owned businesses. Whilst the regulatory framework of the US can be complex and vary significantly across jurisdictions and industries, with professional financial and legal guidance, compliance is absolutely achievable.

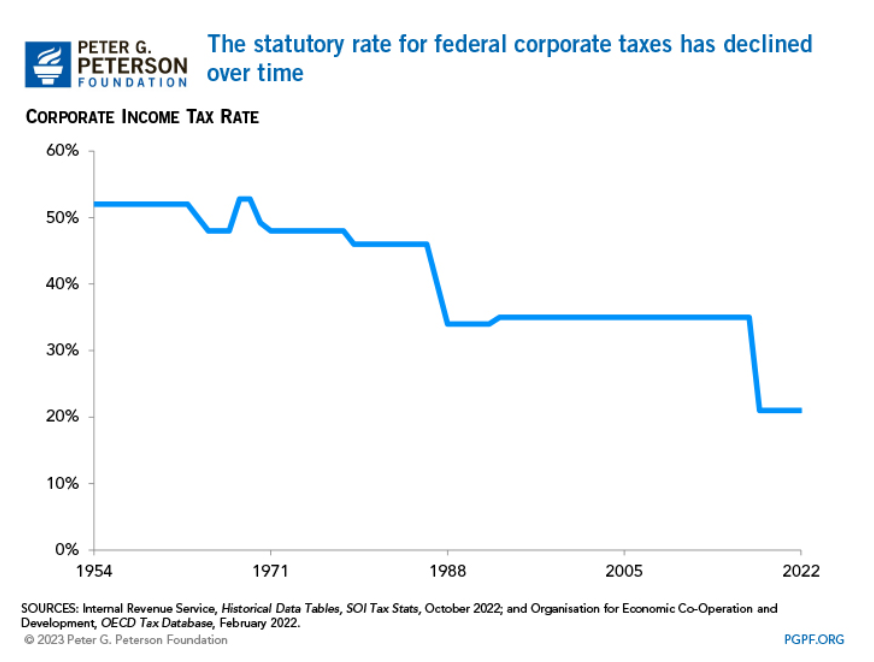

There are compelling cultural ties between the UK and the US, making it simpler to establish and market a business without some of the barriers that would be present in other countries. Corporation tax has also been decreasing across the decades and as a share of GDP, US corporate income tax revenue is lower than that of most G7 countries, signifying a pro-trade, pro-business environment.

The US maintains an extensive network of trade agreements and treaties that facilitate international trade and investment. While trade tensions and protectionist measures may arise from time to time, the US generally supports free trade principles and offers favorable market access for foreign goods and services.

Sustainability, technology and innovation are at the forefront of current U.S. federal government policy, offering opportunities for entrepreneurs to be a part of rapid technological advances and take advantage of huge investments into business, infrastructure and transport in the country. The American Rescue Plan highlights the considerable investment that has gone into economic recovery post-pandemic resulting in a record 16 million small business applications in 2023 and the strongest job growth in American history.

As you can see, the US ticks many of the boxes for UK businesses hoping to enter the market. Many UK businesses have successfully expanded into North America establishing subsidiaries, partnerships or direct operations to tap into the opportunities offered by the region.

What are the Barriers to Expansion?

According to HSBC, a quarter of those businesses that were already trading globally in 2023 said that the finance for international growth had become harder to come by (an increase of 7% versus 2022). Typically, as economic conditions worsen, businesses become a higher risk for domestic banks. It follows then, that international investment would be an even riskier proposition as uncertainty both globally and domestically is resulting in banks being more conservative in lending across the board.

Other barriers cited include cash flow and keeping costs down, both of which are pressing issues for UK businesses and also closely related to profitability and being able to secure appropriate finance.

Alternative Lenders Stepping in to Fill the Financing Gap

At Sallyport, we’ve helped a number of UK companies expand into North America despite domestic lending challenges. Alternative lenders can be more flexible than traditional banks; many of them rely on private equity and as they’re not as heavily regulated as traditional banks, they can take more risks. They also tend to have access to a range of innovative finance options such as supply-chain financing, trade finance, revenue-based and asset-based lending. Being able to construct a financial solution with the elements cherry-picked for the business is a big advantage to UK businesses hoping to expand into the US or Canada; that and leaning on the local expertise, knowledge and extensive networks of the finance provider.

It’s crucial for businesses to carefully evaluate their financial needs, risks and growth projections when choosing the right financing strategy. Engaging with financial advisors, consulting with international trade experts and leveraging resources provided by government trade agencies can help businesses navigate the complexities of international expansion and secure the necessary funding.

Investigate, Evaluate and Embrace Global Expansion

Overall, while the US regulatory environment can be complex and challenging to navigate, foreign businesses can find ample opportunities for investment and growth in the country. With proper due diligence, legal counsel and strategic planning, foreign investors can successfully establish and operate very successful businesses in the United States.

Many of the Sallyport leadership team have spent their professional lives working across the UK and North America and have decades of experience to share with UK business owners aspiring to grow their organizations into the region. Reach out today to talk to us about your plans for North American expansion.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Labor Market Shortages Stifling SME Growth

Since the U.S. has started to resume business-as-normal there’s been talk of a labor market shortage emerging and creating a…

Read MorePartnerships that Protect Treasury Management

Treasury management is the process of managing an organization’s financial resources in order to optimize cash flow, minimize financial risk…

Read MoreVideos

The Most Financial Time of the Year

Sallyport commercial finance’s Annual Holiday Music Video!

View NowAmerican Business Women’s Day

Sallyport Commercial Finance Celebrates American Business Women’s Day

View Now