Newsroom

Sallyport Commercial Finance Supports a Business with a Multi-Million Dollar Credit Facility

Texas – Sallyport Commercial Finance arranges a $8,500,000 Accounts Receivable facility to an established construction supply company serving North Texas.

This Entrepreneurial business had enjoyed rapid growth and success for over 20 years when a strategic investment misfired causing a breach of their bank covenants. The new business team at a proposed replacement bank promised they would get the deal done, but after months of underwriting the Credit Department declined the $8.5m facility for the company. With 450 jobs on the rocks, and just a few weeks until their deadline, the newly installed CFO turned to his network for recommendations. They suggested Sallyport, an entrepreneurial Lender that could get their arms around the transaction quickly and execute with certainty.

“We were proud to be able to help this business right their ship and set a solid course towards their destination with all hands on board. It is extremely satisfying that our recommendation came from an experienced private equity CFO who is presently a client. Can there be any better recommendation?” states Nick Hart, President of Sallyport Commercial Finance.

Feeling the pressure of day to day operations and the looming deadline to find another lender, the owners turned to a solution-based finance company that could understand their plight and support their growth. Sallyport is happy to provide the necessary working capital so the company can continue to expand their services and return to traditional banking, ultimately fulfilling their hopes and dreams of selling the business in the future.

Search

News

$500K Boost: Sallyport Helps Meat Processor Thrive

At Sallyport, we believe in fueling the ambitions of business owners with the financial support they need to thrive. We’re…

Read More$1,750,000 to Keep Oilfield Businesses Flowing

At Sallyport, we’re committed to helping businesses overcome cash flow challenges and achieve their long-term goals. We’re excited to announce…

Read MoreArticles

Recycling Industry : From Niche to Mainstream

Awareness around environmental impact and prevention of climate change has really gathered pace over the past 40 years, shaping the…

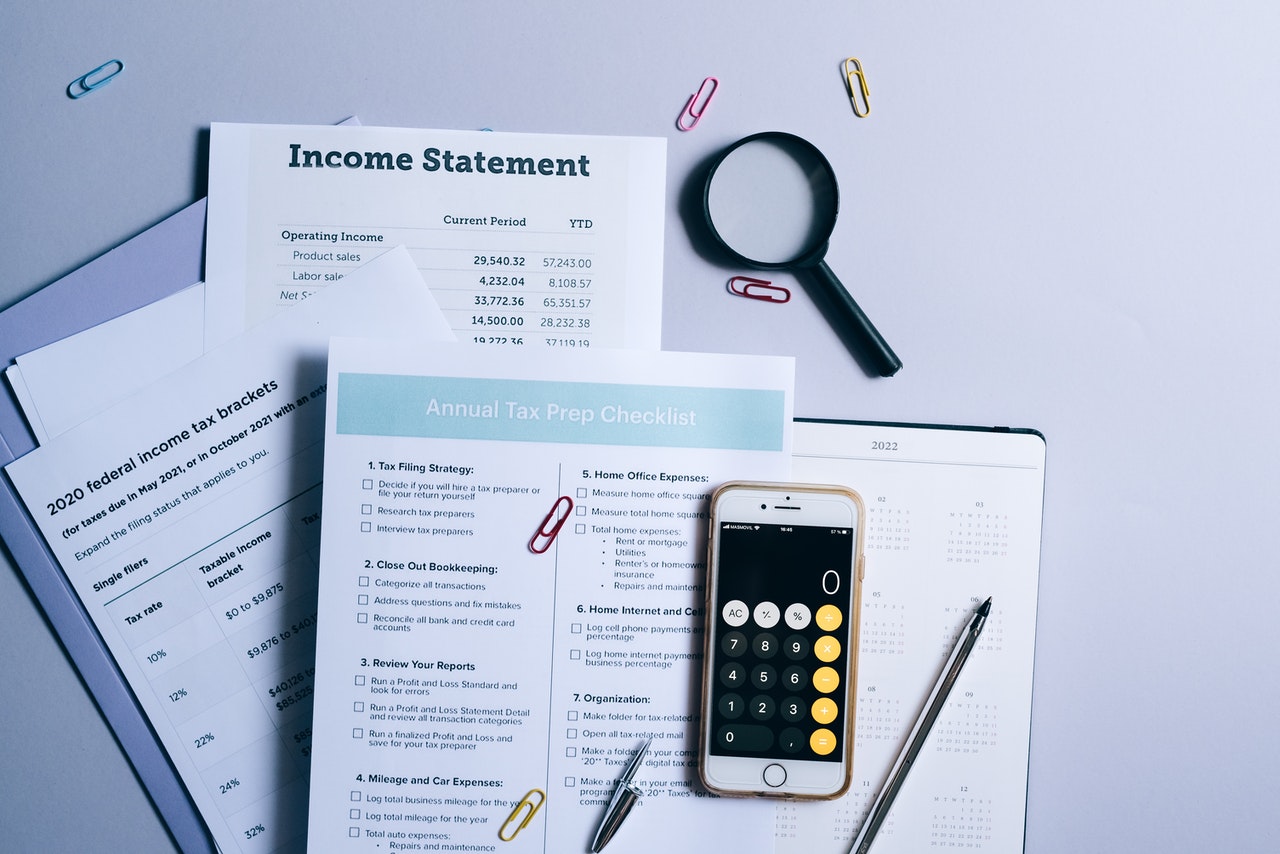

Read More2021 Year-End Financial Checklist for Small Business

Business owners are busy all year round but as the holiday season approaches, things reach a new level of hectic.…

Read MoreVideos

The Most Financial Time of the Year

Sallyport commercial finance’s Annual Holiday Music Video!

View NowWhat is Factoring?

Here we explain what exactly factoring is and how we can help your cash flow…

View Now