Articles & Videos

Pharma Industry Bounces Back to Health

The pharma industry, a critical pillar of the global economy and healthcare system, has seen dramatic shifts in the last few years. It reached unprecedented heights during the COVID-19 pandemic but then experienced a post-pandemic slump as the immediate demand for vaccines and treatments diminished. However, as we approach the end of 2024, the industry is once again on the rise, driven by renewed demand, innovation and strategic investments. This resurgence is marked by notable trends that benefit both large and small players, with a particular focus on smaller companies thriving in niche markets. We’re going to look at how the pharmaceutical sector has bounced back and how small-medium sized pharma businesses are capitalizing on market growth and securing the finance needed to capitalize on this growth.

The Rise, Fall, and Rebirth of the Pharmaceutical Industry

Peaking During COVID-19

The COVID-19 pandemic, which began in 2020, placed the pharmaceutical industry at the forefront of global attention. The rapid development of vaccines, treatments, and diagnostic tools became critical to controlling the spread of the virus. This unprecedented demand for solutions led to the most significant boom the industry had seen in decades. Major pharmaceutical companies such as Pfizer, Moderna, and AstraZeneca reaped the benefits of mass vaccine production and distribution, propelling the global market to a valuation of over $1.27 trillion by 2020, according to PwC’s research. The race to develop life-saving vaccines also sparked rapid growth in biotech and research-based pharma companies.

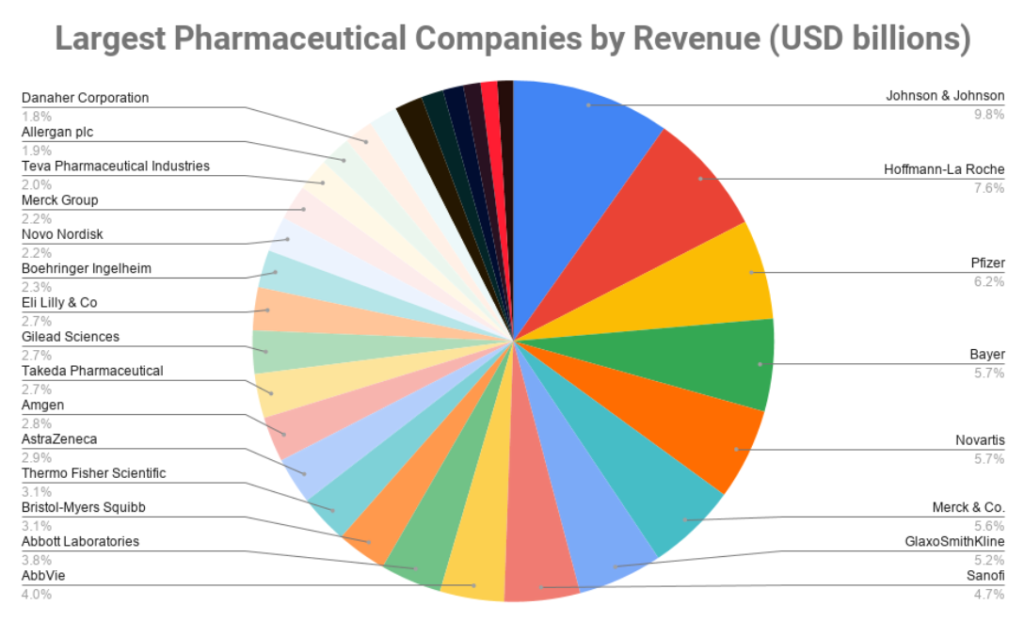

Source: Bizvibe.com, Largest Pharmaceutical Companies by Revenue 2020 (USD billions)

The Post-Pandemic Slump

However, as vaccination campaigns reached saturation levels and the pandemic became more manageable, the industry experienced a notable decline. The sudden drop in COVID-related revenues, coupled with increased competition and expiring patents, led to a downturn for many pharmaceutical companies. Analysts reported a slowdown in revenue growth across the board in 2022, with some key players in the vaccine and therapeutic markets experiencing reduced sales . Furthermore, geopolitical tensions, supply chain disruptions and inflation added financial pressure, resulting in a challenging period for the industry as it recalibrated its focus post-COVID.

Bouncing Back in 2024

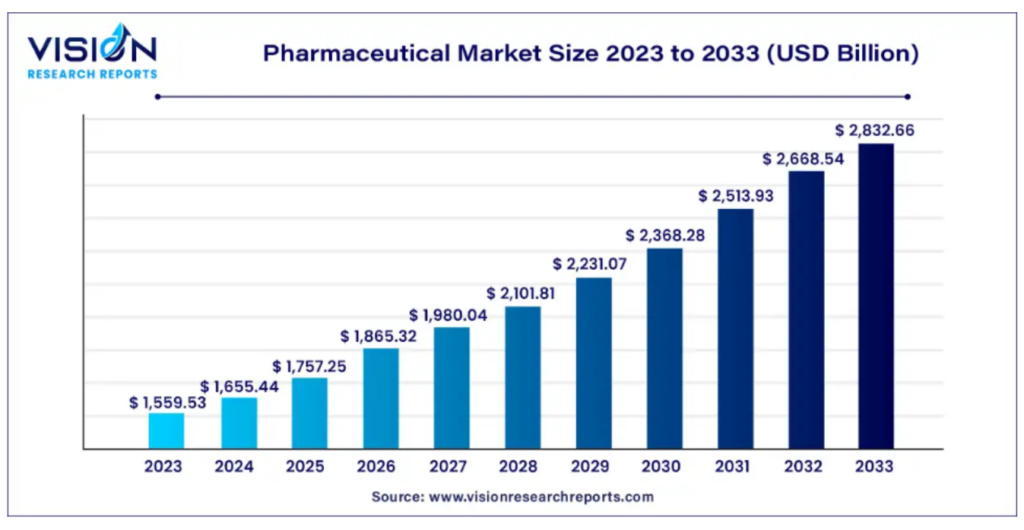

Despite these challenges, the industry is bouncing back in 2024. A resurgence in demand for innovative therapies, especially in areas such as oncology, rare diseases, and gene therapy, is driving the market’s recovery. According to recent projections from Vision Research Reports, the global pharmaceutical market is expected to grow at a compound annual growth rate (CAGR) of 6.15% between 2024 and 2033, with the market forecasted to reach $2.8 billion by 2033 . This recovery is fueled by increased investments in research and development (R&D), a growing elderly population in need of chronic care treatments, an increasing need for effective mental health treatments, the need for more affordable prescription medications and a rising interest in precision medicine and gene therapy treatments.

In addition, regulatory advancements, such as the accelerated approval of breakthrough therapies, have further spurred growth. Companies are increasingly focusing on personalized and gene therapies, which offer targeted treatments for diseases that were once difficult to treat. The development of these high-margin, high-demand drugs is helping to restore industry confidence.

Current Trends Driving Industry Growth

Niche Markets Powering Smaller Pharma Companies

While the pharmaceutical giants continue to innovate and expand, smaller companies are finding success by focusing on niche markets. These smaller firms are often more agile, allowing them to explore specialized areas of medicine that larger companies may overlook. For example, many small-to-medium-sized enterprises (SMEs) are targeting orphan drugs, which treat rare diseases and conditions that affect a limited number of patients. The orphan drug market is expected to grow significantly, as regulatory bodies like the FDA and EMA offer incentives, such as market exclusivity and tax credits, to encourage the development of treatments for rare diseases .

Another emerging trend is the focus on biopharma. Small biotech firms are developing innovative treatments using biological processes, often partnering with larger pharma companies for funding and distribution. As of 2024, the biopharmaceutical sector is one of the fastest-growing areas in the pharmaceutical industry, with gene therapies, monoclonal antibodies, and cell-based treatments leading the charge. These therapies provide personalized, effective solutions for a range of complex diseases, from cancer to autoimmune disorders.

In addition, the increased use of artificial intelligence (AI) and machine learning in drug discovery is allowing smaller companies to identify new drug candidates faster and more cost-effectively than traditional methods. This is helping to level the playing field for SMEs, enabling them to compete with larger companies in developing breakthrough therapies.

Access to Finance for Small and Medium-Sized Pharma Companies

While large pharmaceutical companies often have the resources to fund extensive R&D projects, smaller companies face significant financial hurdles. Bringing a new drug to market is a costly endeavor, with some estimates suggesting that the process can cost over $1 billion and take upwards of 10 years. However, as the pharmaceutical landscape evolves, more alternative finance options are emerging to help SMEs get their innovative treatments off the ground.

Traditional funding sources, such as venture capital (VC) and private equity (PE), remain popular in the pharma and biotech sectors. However, alternative financing methods, such as revenue-based financing, royalty financing, and asset-based lending, are quickly gaining traction. These financing models allow smaller companies to secure funding without relinquishing significant equity or control, making them an attractive option for newer, less established businesses.

For example, royalty-based financing enables companies to receive upfront capital in exchange for a percentage of future revenue generated by their drug or therapy. This model is particularly appealing for companies in the later stages of clinical development, as it provides the capital needed to complete trials and bring their products to market without diluting ownership. Similarly, asset-based lending allows pharma companies to borrow against the value of their intellectual property, such as patents, offering another viable financing route.

Another rising trend is the role of government funding and public-private partnerships. Many governments, recognizing the critical importance of the pharmaceutical industry in public health, have introduced grants and incentives aimed at encouraging innovation. For example, initiatives like Horizon Europe for Canadian Businesses and the U.S. National Institutes of Health (NIH) funding programs have provided billions in funding for research projects, helping smaller companies bridge the gap between discovery and commercialization.

How Alternative Finance is Helping Small Pharma Thrive

Access to finance is essential for small pharmaceutical companies looking to enter niche markets or develop innovative treatments. Alternative finance options, such as debt-based financing or non-traditional equity models, can provide a lifeline for companies that don’t yet have the track record or revenue to secure conventional loans.

Crowdfunding platforms are also playing a role in this space. In recent years, larger biotech and pharma companies have raised millions through equity crowdfunding, allowing them to engage directly with the public and generate buzz around their projects. This method of financing has proven particularly effective for companies working on groundbreaking therapies, as it allows them to build a community of investors and advocates who are personally invested in the success of their treatments.

Furthermore, digital health companies offering pharma-related services, such as AI-driven drug discovery or telemedicine solutions, are increasingly turning to venture debt or convertible notes to secure funding without sacrificing equity. This trend is empowering small and medium-sized businesses to access the capital they need to drive innovation, compete with larger companies, and bring new therapies to market.

For small and medium-sized pharmaceutical companies, securing the capital needed to fund research, development, and market expansion can be challenging. Traditional financing methods like venture capital (VC) and crowdfunding may seem appealing, but they come with significant drawbacks. Venture debt often burdens SMEs with high-interest rates and tight repayment schedules, which can stifle cash flow and strain resources. Crowdfunding, while popular in the tech space, can be unpredictable and time-consuming, requiring significant marketing efforts to gain traction, with no guarantee of raising the necessary funds.

An increasingly attractive alternative for pharma SMEs is receivables finance, including options such as invoice factoring and asset-based lending. These financing methods allow companies to unlock the value of their current assets, providing immediate working capital without the burden of traditional loans or the loss of equity.

- Invoice factoring involves selling outstanding invoices to a third party at a discount, allowing companies to access funds before their clients make payment. This method is particularly useful for pharma companies that rely on large contracts with extended payment terms, enabling them to maintain cash flow and fund operations while waiting for invoice settlements. Since the funds are tied to existing receivables, businesses can secure financing quickly and efficiently, without taking on new debt.

- Asset-based lending (ABL) enables companies to borrow against assets such as equipment, patents, or inventory. This form of lending is flexible, allowing SMEs to leverage their tangible and intangible assets to access capital. For pharmaceutical companies with valuable intellectual property or a strong pipeline of products, ABL offers a way to finance growth without diluting ownership or relying on uncertain external funding.

Both of these alternative finance solutions offer significant advantages over venture debt or crowdfunding. They provide fast access to capital based on existing assets and accounts receivable, allowing companies to focus on development and growth without incurring excessive debt or giving up equity. For small pharmaceutical companies looking to scale or bring new treatments to market, receivables finance and asset-based lending can be the lifeline that keeps their business moving forward.

What Does the Future Hold for the Pharma Industry?

Looking ahead to 2025 and beyond, the pharmaceutical industry appears poised for continued growth and transformation. Key areas to watch include:

Continued innovation in personalized medicine: The shift towards personalized medicine, where treatments are tailored to individual patients based on their genetic makeup, will only accelerate. Expect more breakthroughs in gene therapies, cancer immunotherapies, and targeted drugs that offer higher efficacy with fewer side effects.

Expansion of digital health technologies: The integration of AI, machine learning, and digital health solutions into the pharma landscape will drive efficiency in drug discovery, patient care, and data management. Digital therapeutics will continue to grow, offering patients innovative ways to manage chronic conditions and improve health outcomes.

Increased consolidation: As competition heats up, larger pharmaceutical companies may look to acquire smaller, innovative firms that specialize in niche markets or have developed promising therapies. This trend could lead to more M&A activity in 2025, providing smaller players with exit opportunities while fueling growth for larger organizations.

Regulatory changes and global market expansion: The global pharma market will expand, with emerging markets in Asia, Africa, and Latin America playing a more significant role in drug manufacturing and distribution. Regulatory agencies may introduce new frameworks to address the challenges posed by the growing complexity of modern therapies, particularly gene editing and AI-driven drugs.

If you’re a small or medium-sized pharmaceutical company looking to capitalize on these trends and grow your business, securing the right financing is critical. Reach out to our funding specialists to explore the financial options available to help your company thrive in this dynamic industry. From alternative finance solutions such as asset-based lending and receivables financing, we can guide you through the process and ensure that your business is positioned for success in 2025 and beyond.

The pharmaceutical industry is bouncing back with new vigor—now’s the time to be part of its exciting future!

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Does Your Business Qualify for the ERTC Tax Credit?

The Employee Retention Tax Credit (ERTC) was established in 2020 as part of the CARES act in order to encourage…

Read MoreFears Grow Over Unprecedented Canadian Rail Shutdown

It’s not the news that business leaders were hoping for but the failure of negotiations last night marks the start…

Read MoreVideos

The Most Financial Time of the Year

Sallyport commercial finance’s Annual Holiday Music Video!

View Now