Articles & Videos

Mastering Accounts Receivable Management : A Perpetual Cycle

Effective financial management is crucial for the success of any business and a key component of this is proficient accounts receivable management. In this comprehensive guide, we’ll delve into the intricacies of accounts receivable (AR) management, exploring what it entails, how to optimize the process and what the best practices are to enhance your business’s financial health.

What is Accounts Receivable Management?

Accounts Receivable Management is a critical financial function that involves overseeing the process of collecting outstanding payments from customers or clients. In simpler terms, it’s ensuring that the money owed to your business is collected in a timely and efficient manner.

The AR management process typically includes generating and sending invoices, tracking payment receipts and managing communication with clients regarding outstanding balances. It plays a pivotal role in maintaining a healthy cash flow and preventing potential financial bottlenecks.

Why Should Businesses Prioritize AR Management?

Effective accounts receivable management is a fundamental aspect of financial management for businesses. It helps maintain a healthy cash flow, reduces financial risks, fosters positive customer relationships and contributes to the overall stability and success of the organization. Here are just a few reasons businesses should concentrate on AR management;

Working Capital & Cash Flow Optimization

Achieving steady and predictable cash flow is arguably the biggest reason to improve AR management. Timely collection of receivables allows the company to have the necessary funds to meet its operational expenses, invest in growth opportunities, and handle unforeseen financial challenges. In a similar respect, accounts receivable is a crucial component of a company’s working capital. By focusing on good AR management, optional working capital may be possible as the time it takes to turn accounts receivable into cash is reduced. This usually means a business can use its capital more effectively.

Credit & Debt Risk

Assessing and managing credit risk is a critical aspect of accounts receivable management. Businesses need to evaluate the creditworthiness of customers before extending credit terms to minimize the risk of late or non-payment.

In regards to existing accounts, monitoring and managing accounts receivable helps identify potential issues with late or non-payment. By implementing effective credit policies, businesses can reduce the risk of bad debts and minimize losses associated with customers who default on their payments.

Customer Relationships

A well-managed accounts receivable process contributes to positive customer relationships. Clear and consistent communication about invoicing, payment terms and follow-up, can enhance transparency and trust with customers. This, in turn, can lead to repeat business and positive word-of-mouth referrals.

Cost Reduction

Streamlining accounts receivable processes can lead to cost reductions. Efficient invoicing and collection practices can minimize administrative burden and the costs associated with chasing late payments, resolving disputes and managing bad debts.

Financial Planning

Accurate and up-to-date accounts receivable information is essential for effective financial planning. Businesses rely on this information to make informed decisions about budgeting, forecasting and setting realistic financial goals.

Compliance

Ensuring compliance with accounting standards and regulatory requirements is essential for the financial integrity of a business. Proper accounts receivable management helps maintain accurate financial records and supports compliance with reporting standards.

As you can see from above, all the reasons to improve AR management are directly or indirectly related to cash flow. Positive cash flow is inherent to demonstrating financial health, which in turn helps to make the business more attractive to lenders and investors when seeking financing. Indeed, a favorable accounts receivable position can be used as collateral for financing such as invoice factoring, even when other elements of financial standing are detrimental to securing finance.

What Makes Good Accounts Receivable Management Practices?

There are several practices that a business must adopt, refine and continue to tweak as required to maintain optimal accounts receivable…

- Provide detailed and transparent invoices to your clients which clearly state payment terms, payment options, due dates and outline any late fees.

- Provide a range of different payment methods for the client’s convenience and consider using online payment systems for faster turnaround.

- Put regular reporting in place to track the status of accounts receivable and analyze aging reports to identify and address overdue accounts.

- Implement a systematic follow-up process for overdue payments, addressing them as early as possible and utilize automated reminders prior to accounts becoming due. Using automated systems for invoicing, reminders and tracking can reduce the risk of manual errors and enhance efficiency.

- Establish comprehensive policies on how to evaluate customer creditworthiness and ensure that you understand how to extend credit to customers the right way. Credit policies and limits should be regularly reviewed and adjusted, in order to protect the business’ interests. Employees and clients should be aware of these policies and routinely updated on changes.

- Nourish open customer communication with customers, building a professional and reciprocal relationship that makes it easier to address payment issues promptly if they arise.

- Where possible, negotiate with clients for mutually beneficial payment terms. Consider offering discounts for early payments where it’s sensible for optimizing cash flow.

- In order to ensure a holistic approach to accounts receivable management, create a cross-functional team to include finance, sales and customer service; all the departments that need to collaborate for effective AR management.

How Do Invoice Factoring Companies Help with Accounts Receivable Management?

Invoice factoring companies play a crucial role in accounts receivable management by offering financing solutions that allow businesses to access cash quickly. They purchase outstanding invoices from businesses at a discount, providing immediate working capital. Whilst, factoring companies focus on the financing aspect of accounts receivable, some may offer additional added-value services related to receivables management and best-practices.

Some of the additional services on offer may include assessing the creditworthiness of clients and prospects in order to mitigate credit risk and taking on the responsibility of invoicing and collecting payments from your customers, thereby relieving the administrative burden faced by businesses.

Working with a factoring company can give a business access to a dedicated and experienced account manager who can offer valuable guidance on enhancing the invoicing and collections process. The factor may also be able to provide customized reporting to give business insight and detailed analytics related to their collections and cash flow position.

How to Measure Performance of Accounts Receivable Management?

Now that all the hard work has gone into improving your processes, you’ll want to measure the impact that’s having on your AR on an ongoing basis using some common calculations and reporting methods.

Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) calculates the average number of days it takes to collect payments. A lower DSO indicates efficient accounts receivable management whereas a higher DSO suggests that the company could be experiencing delays in receiving payments, ultimately causing a cash flow constraint. Typically, a DSO of under 45 days is considered low.

Cash Flow Analysis

Regular analysis of cash flow statements can help to identify patterns related to accounts receivable before they become problems.

Aging Reports

Review aging reports to understand the distribution of outstanding payments and address any overdue accounts based on priority.

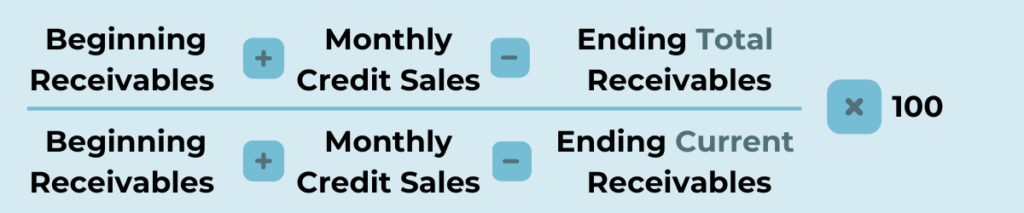

Collection Effectiveness Index (CEI)

The CEI is used to assess the efficiency of collections. Higher CEI values indicate effective accounts receivable management. This calculation is made by dividing the total amount of money collected by the total amount of money owed. In more simple terms, CEI is a measure of a company’s ability to retrieve their accounts receivable from customers.

Tracking CEI will enable you to see if it starts to decrease for any reason; generally, a CEI of 50 or below suggests that the business’ collections processes require evaluation and a CEI of 80 or above indicates an effective collections process.

Invoiced.com offers several explanations for this scenario and ways that it might be addressed by some adjustment in AR management.

Customer Satisfaction

Customer satisfaction related to invoicing and payment processes is a useful gauge on whether your AR processes are working efficiently and enables you to address any concerns or issues swiftly.

The Final Word on Mastering Accounts Receivable Management

Mastering accounts receivable management is a strategic need for businesses aiming for sustained financial health and growth. Effective accounts receivable management is not a finite task however, but rather a perpetual cycle of assessment, adaptation and improvement.

By implementing effective practices, leveraging technology and staying attuned to industry innovations, organizations can optimize their AR management processes. Whether through internal strategies or by collaborating with invoice factoring companies, businesses have various avenues to enhance cash flow, reduce risks and cultivate lasting financial success.

Reach out to find out more about leveraging the Accounts Receivable Management expertise of Sallyport’s experienced team whilst improving your cash flow position.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

How to Choose an Invoice Factoring Company

You’ve already done your research and invoice factoring seems to be the most suitable option for financing your business. Other…

Read MoreUK Businesses Eyeing Global Expansion in 2024

The International Monetary Fund (IMF) predicts resilient global economic growth in 2024 with a 3.1% increase in GDP. Whilst most…

Read MoreVideos

The Most Financial Time of the Year

Sallyport commercial finance’s Annual Holiday Music Video!

View NowPopkoffs Client Testimonial

Popkoffs Client Testimonial

View Now