Articles & Videos

Finding the Right Finance for Engineering

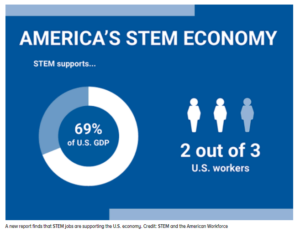

The economies of the US and Canada are heavily reliant on the success of the engineering sector which is a major contributor to GDP and taxes and creates millions of jobs both directly and indirectly. The strength of a country’s engineering industry and the propensity to improve and innovate for the future can also be viewed as a measure of how competitive that economy is on the global stage.

In the decade that followed the last recession, engineering businesses have had a tough time of it, wrestling with a number of challenges inhibiting profitability and then the unprecedented dip of 2020 hit and engineering firms particularly in the SME space may once again be facing struggles that they’d hoped had passed.

The primary challenges lay around skills shortages. Most engineering fields require highly skilled workers with prestigious qualifications, certifications and experience and more often than not, a robust combination of all three. After the big downturn worldwide, many engineers left the industry and as the skilled workforce ages and retires and technology continues to advance requiring new skills from a younger workforce, the skills gap has continued to widen. A huge proportion of North America’s skilled engineering talent are immigrants and the lack of movement of international workers over the last year and a half coupled with the lack of activity in construction has added to concerns for business recovery.

With increased competition from international importers ramping up, including consultative services, engineering firms are looking to large construction and oil and gas projects to bolster growth but as we’ve seen austerity in oil and gas CAPEX spending recently and for the foreseeable future, the danger for engineering businesses is in putting all eggs in one basket. Whilst North American construction is expected to grow significantly in the coming years and the US infrastructure bill will certainly help, there are still complexities in the shorter-term that suppress growth in the construction market, not least supply chain challenges across a growing amount of materials.

Finding finance for growth

Growth is power in the engineering business and from startup to well established company, finding the right finance for engineering at just the right time is fundamental to success. There are several contenders for investment in an engineering business and with finite funds, there will be decisions to be made on where best to put cash. Some of the main areas for driving growth are;

Technology

As with many industries, adoption of automation and other technologies to improve efficiency has been fast-forwarded by many years thanks to the pandemic situation. Most forward-thinking companies are using 3D printing technologies as standard and whilst capital expenditure on equipment may have been placed on the back burner in recent years due to instability in the economy, failure to invest in new methods will doubtless leave smaller engineering companies at a disadvantage.

Rather than buying expensive equipment outright, engineering businesses may consider equipment finance as a viable alternative. Choosing to lease equipment means cash flow is easier to manage on a monthly basis and as the investment is a monthly expense versus a business asset, the tax burden is lessened.

Sustainability

If it wasn’t clear before, this weeks’ report from the International Panel on Climate Change (IPCC) confirms that transitioning to sustainable practices is no longer an option, it’s a necessity and has a far bigger purpose than the survival of business alone. Although making the transition to environmentally-neutral policies is far from ‘cheap’, engineering businesses must try to plan for this and allocate budget sooner rather than later. Many of the costs of implementing new ‘green’ practices can be offset through a multitude of tax incentives, energy savings and attracting an ever-growing market of eco-conscious customers.

Hiring Key Personnel and Payroll Expenses

For smaller companies or those in less urban locations, attracting top talent is simply beyond budget when competing alongside bigger competitors with deeper pockets. Having said that, there’s less restrictions on where we have to be located for work now so having a flexible source of funding could prove key to securing a crucial new hire for the business with specific technology expertise, skill set or experience.

It may also be that having invested into a costly piece of new equipment or taking on high-salary employees, cash flow has been temporarily squeezed in the short-term – alternative finance options are a great solution to making monthly payroll commitments and strengthening working capital whilst getting back on track.

Expansion into new markets

Whether geographic expansion is on the cards or there’s opportunity to advance business via consolidation or the development of niche product offerings, flexible modes of finance will be needed as and when the moment arrives. Engineering businesses are under increasing pressure from low-cost international players so allocating funds towards investigating and entering into new, more niche products and markets should be a priority part of any resilient business plan.

Regulations, Taxes and Insurance

Health and safety regulations in the present day are only getting more stringent as are the occurrence of more extreme weather events that cause interruptions and loss to business. Insurances are required to cover all eventualities and indications are that this is an increasing cost for engineering and other businesses. Many engineering startups certainly have the technical expertise to succeed, however advice on business taxes and regulations from professionals will negate the risk of costly mistakes in the early years. An engineering entrepreneurs’ skills might not extend to effective marketing of the business either, nonetheless, support will be needed to promote the company’s offerings and financing these initiatives is sometimes difficult for newer organizations.

Act now for a bright future

The North American engineering industry is poised for growth and those that take action to adapt now will be better placed to have a part of that growth. Don’t let lack of finance for a fantastic idea or new technology hold your business back. Reach out to Sallyport’s team to discuss your growth ambitions and how our tailored finance solutions can help build your engineering enterprise succeed.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Print Industry Pushed To Limits

In many industries stock constraints have begun to ease over recent weeks. Fears over virus cases and transmission seem finally…

Read MoreCanadian Labour Market Stalls: A Concern for Businesses?

In June 2024, the Canadian labour market witnessed a surprising development with the loss of 1,400 jobs, marking a rare…

Read MoreVideos

American Business Women’s Day

Sallyport Commercial Finance Celebrates American Business Women’s Day

View Now