Articles & Videos

Destination Madagascar for Apparel Businesses?

Madagascar, the fourth largest island in the world, located off the southeastern coast of Africa, has experienced a period of economic growth in recent years that is gradually positioning it as an attractive destination for foreign investment, particularly from those seeking a new base for apparel businesses. While the country has historically faced significant challenges, including political instability and poverty, recent developments have begun to create a more favorable environment for economic development. This transformation is underpinned by strategic reforms, improvements in infrastructure, and the country’s rich natural resources, which collectively have piqued the interest of international investors.

Madagascar’s Economic Growth in Recent Years

Madagascar’s economy has shown considerable resilience and growth potential, particularly since 2013, following the restoration of political stability after years of turmoil. The country’s Gross Domestic Product (GDP) has steadily increased, with annual GDP growth rates averaging around 4% over the past decade (omitting the decline due to COVID-19 in 2020). This growth, while modest compared to some other African nations, represents a significant turnaround for Madagascar, which has faced numerous socio-economic challenges.

One of the key drivers of Madagascar’s economic growth has been the agricultural sector, which employs around 80% of the population. Vanilla, cloves and coffee are among the main exports, with Madagascar being the world’s largest producer of vanilla. The country’s agriculture sector benefits from a favorable climate and rich soils, enabling it to produce high-quality products that are in demand globally. The government has also initiated programs aimed at improving agricultural productivity and expanding access to international markets, further boosting the sector’s contribution to the economy.

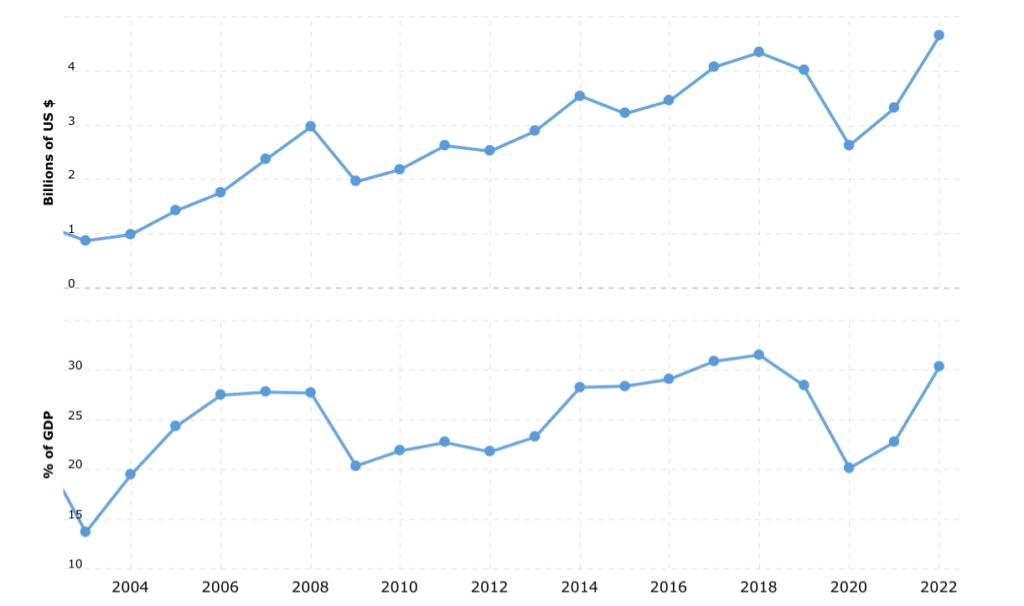

Growth of Madagascar’s Exports 2004-2022

Source: MacroTrends, Accessed 11.08.2024.

In addition to agriculture, the mining sector has emerged as a critical contributor to Madagascar’s economic growth. The island is rich in minerals, including nickel, cobalt, and precious stones like sapphires. The Ambatovy mine, one of the largest nickel and cobalt mines in the world, has played a significant role in the country’s economic development. The government has been keen to attract foreign investment in the mining sector by offering incentives and ensuring a stable regulatory environment, which has encouraged multinational companies to establish operations in Madagascar.

Tourism is another sector with substantial growth potential, given Madagascar’s unique biodiversity and cultural heritage. The island is home to a vast array of endemic species, including lemurs, chameleons, and numerous plant species, making it a global hotspot for ecotourism. Efforts to improve infrastructure, such as roads and airports, have made it easier for tourists to access remote parts of the country, thereby boosting tourism revenue.

What’s the Attraction for North American Businesses?

Madagascar presents several opportunities for North American businesses, driven by its strategic location, growing economy and improving business environment. The island’s proximity to major African and Asian markets makes it an ideal hub for companies looking to expand their operations in these regions. Furthermore, Madagascar is a member of the Southern African Development Community (SADC) and the Common Market for Eastern and Southern Africa (COMESA), providing preferential access to a market of over 600 million consumers.

The government of Madagascar has made significant strides in creating a more business-friendly environment, recognizing the importance of foreign direct investment (FDI) in driving economic growth. Reforms aimed at simplifying business registration processes, improving the legal framework for investors, and reducing barriers to trade have been implemented. Additionally, the establishment of Special Economic Zones (SEZs) has provided attractive incentives for foreign companies, including tax breaks and simplified customs procedures.

One of the key attractions for North American businesses is Madagascar’s young and growing workforce. With a median age of around 20 years, the country boasts a large pool of labor that is not only cost-competitive but also increasingly skilled. The government has placed a strong emphasis on education and vocational training, particularly in areas such as information technology and manufacturing, to ensure that the workforce is equipped to meet the needs of modern industries.

Madagascar’s rich natural resources also offer significant opportunities for North American businesses, particularly in the extractive industries. The country’s abundant mineral reserves, coupled with favorable investment policies, have already attracted major mining companies. North American firms can leverage their technological expertise and capital to tap into these resources, contributing to the country’s economic development while benefiting from access to valuable raw materials.

Big Appeal for Foreign Apparel Businesses

The apparel industry is one of the sectors where Madagascar holds significant appeal for foreign investors, particularly those from North America. The country has a long history in textile and garment manufacturing and it has developed a reputation for producing high-quality products at competitive prices. The combination of low labor costs, a skilled workforce and favorable trade agreements makes Madagascar an attractive destination for apparel businesses looking to set up manufacturing operations.

One of the key advantages for apparel businesses in Madagascar is the country’s eligibility for the African Growth and Opportunity Act (AGOA), which provides duty-free access to the U.S. market for a wide range of products, including textiles and apparel. This preferential trade agreement offers significant cost savings for North American companies that choose to manufacture in Madagascar and export to the United States. In 2022, Madagascar was the fifth-largest exporter of products to the US under AGOA at $406 million, the majority of which was Apparel. Additionally, Madagascar has signed trade agreements with the European Union, providing similar benefits for companies targeting European markets.

The government has also been proactive in supporting the growth of the apparel industry by establishing SEZs specifically tailored to textile and garment manufacturing. These zones offer a range of incentives, including tax holidays, reduced customs duties and access to well-developed infrastructure. The SEZs are strategically located near major ports, facilitating easy access to international shipping routes and reducing transportation costs for export-oriented businesses.

Furthermore, Madagascar’s commitment to sustainability and ethical manufacturing practices has become an increasingly important factor for foreign apparel businesses. With growing consumer demand for environmentally friendly and socially responsible products, many companies are seeking to establish operations in locations that align with these values. Madagascar’s emphasis on sustainable agriculture, responsible sourcing of materials and fair labor practices makes it an attractive destination for apparel businesses that prioritize ethical production.

A Detailed Look at Tax Incentives for Madagascan Apparel Manufacturers

North American businesses considering setting up operations in Madagascar can benefit from several specific tax incentives designed to attract foreign investment and stimulate economic growth. These tax benefits are part of Madagascar’s broader strategy to create a business-friendly environment and include the following:

1. Special Economic Zones (SEZs) Tax Benefits

- Corporate Income Tax Holidays: Businesses that establish operations within Madagascar’s SEZs can benefit from a corporate income tax holiday, typically for a period of 5 to 15 years, depending on the nature and size of the investment. This allows companies to reinvest profits into the business during the early years without the burden of corporate taxes.

- Reduced Corporate Tax Rates: After the tax holiday period, companies operating in SEZs may enjoy reduced corporate income tax rates, often lower than the standard rate applied to businesses outside the zones.

- Exemption from Import Duties and VAT: Companies in SEZs are often exempt from import duties and Value Added Tax (VAT) on machinery, equipment, raw materials, and other goods required for production. This can significantly reduce the cost of setting up and operating a manufacturing facility.

- Exemption from Export Taxes: Businesses exporting goods produced in SEZs may be exempt from export taxes, making it more cost-effective to reach international markets, particularly in the apparel sector.

2. Free Trade Agreements and Preferential Trade Status

- African Growth and Opportunity Act (AGOA): Madagascar’s eligibility for AGOA provides duty-free access to the U.S. market for a wide range of products, including textiles and apparel. North American companies can save on tariffs, making their products more competitive in the U.S. market.

- Everything But Arms (EBA) Initiative: Under the EBA initiative, Madagascar enjoys duty-free and quota-free access to European Union markets for all products except arms and ammunition. This benefit can be particularly advantageous for apparel businesses looking to export to Europe.

3. Investment Tax Credits and Deductions

- Investment Allowances: Companies that invest in specific sectors, such as manufacturing, mining, or agriculture, may be eligible for investment allowances. These allowances allow businesses to deduct a percentage of their investment costs from their taxable income, effectively reducing their overall tax liability.

- Accelerated Depreciation: Madagascar offers accelerated depreciation for certain capital expenditures, such as machinery and equipment. This allows companies to write off the cost of these assets more quickly, reducing taxable income in the initial years of operation.

4. Tax Incentives for Reinvestment

- Reinvestment Relief: Businesses that reinvest profits into expanding their operations in Madagascar, such as purchasing new equipment or expanding facilities, may be eligible for additional tax relief. This encourages companies to continue growing their operations within the country.

5. Exemption from Withholding Taxes

- Dividend and Interest Exemptions: Some foreign companies operating in Madagascar may benefit from reduced or exempt withholding taxes on dividends and interest payments to their parent companies. This can lower the cost of repatriating profits to North America.

6. Loss Carryforward Provisions

- Carryforward of Losses: Madagascar allows businesses to carry forward operating losses for several years (usually up to 5 years), enabling them to offset future taxable income. This is particularly beneficial for new companies that may experience initial losses during their startup phase.

7. Double Taxation Treaties

- Avoidance of Double Taxation: Madagascar has entered into double taxation treaties with several countries, including France and Mauritius. While the U.S. does not have a specific double taxation treaty with Madagascar, businesses may benefit from such agreements through subsidiaries in other countries or through broader tax planning strategies.

These tax incentives make Madagascar an attractive destination for North American businesses, particularly in labor-intensive industries like apparel manufacturing. By leveraging these benefits, companies can reduce their overall tax burden, lower operational costs, and enhance their competitiveness in global markets. Of course, taxation policy changes all the time and we would always recommend you seek the advice of finance, legal and accounting professionals before deciding on foreign expansion.

Alternative Business Finance for North American Apparel Companies

As overseas apparel businesses consider expanding or establishing operations in Madagascar, securing adequate financing is crucial. Traditional bank loans may not always be the most suitable option, particularly for companies looking to scale quickly or those operating in new international markets. Alternative business finance options such as invoice finance/factoring, purchase order (PO) finance, supply chain finance and asset-based lending offer flexible and accessible funding solutions that can support the growth and expansion of apparel businesses in Madagascar.

Invoice Finance/Factoring: This form of financing allows businesses to unlock cash tied up in unpaid invoices by selling them to a third-party finance provider at a discount. For apparel companies exporting goods from Madagascar, invoice finance can improve cash flow by providing immediate access to funds, enabling them to reinvest in production, pay suppliers, or cover operational expenses without waiting for customers to settle invoices.

Purchase Order (PO) Finance: PO finance is particularly beneficial for apparel businesses that receive large orders but lack the capital to fulfill them. This financing option allows companies to obtain the necessary funds to pay suppliers and cover production costs before the customer pays for the goods. PO finance can help apparel businesses in Madagascar take on larger contracts and expand their market presence without being constrained by cash flow limitations.

Supply Chain Finance: Supply chain finance provides funding solutions that benefit both buyers and suppliers within a supply chain. For North American apparel businesses operating in Madagascar, supply chain finance can optimize working capital by extending payment terms to suppliers while ensuring they receive timely payments. This arrangement strengthens relationships with local suppliers and supports the stability of the entire supply chain.

Asset-Based Lending: This type of financing involves borrowing against the value of a company’s assets, such as inventory, machinery, or real estate. For apparel businesses with significant tangible assets in Madagascar, asset-based lending can provide a reliable source of capital for expansion, equipment purchases, or other strategic investments. This financing option is particularly attractive for companies that may not have a long credit history but possess valuable assets that can be used as collateral.

Conclusion

Madagascar’s economic growth, driven by its apparel, mining and tourism sectors, coupled with a more favorable business environment, presents significant opportunities for North American businesses, particularly in the apparel industry. The country’s strategic location, young workforce, and access to preferential trade agreements make it an ideal destination for companies looking to expand their operations internationally. For apparel businesses, Madagascar may offer a compelling combination of cost advantages, ethical manufacturing opportunities and government support.

To capitalize on these opportunities, apparel businesses should consider leveraging alternative business finance options such as invoice finance, PO finance, supply chain finance and asset-based lending. These flexible and accessible financing solutions can provide the necessary capital to support growth, manage cash flow, and seize new market opportunities abroad. By adopting these financing strategies, apparel companies can position themselves for long-term success in this emerging market, leveraging the continued growth and development of Madagascar’s economy.

Reach out to our experienced funding team to learn more about the alternative finance options available for the expansion of your apparel business.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

How to Choose an Invoice Factoring Company

You’ve already done your research and invoice factoring seems to be the most suitable option for financing your business. Other…

Read MoreCanadian Business Insolvencies Surge: What Lies Ahead?

In 2024, Canada experienced a significant surge in insolvency filings, with a notable 12.1% increase compared to the previous year.…

Read MoreVideos

What is Factoring?

Here we explain what exactly factoring is and how we can help your cash flow…

View Now