Articles & Videos

Debtor in Possession Financing – A Complete Guide

If your business is experiencing severe financial challenges and considering filing for bankruptcy, all may not be lost as there is a special type of financing meant for businesses that are in bankruptcy. Many businesses will be unaware of the advantages of this type of financing but debtor in possession financing (or DIP financing) is an increasingly common way for businesses to obtain the working capital needed to continue operating whilst they undergo a formal restructure.

It’s generally recognized that a company’s assets have more value as a going concern than they would in liquidation and courts therefore seek to approve DIP financing where appropriate, to preserve solvency; in this way it may be possible to maximize the recovery of debts for creditors and minimize the impact of bankruptcy on employees.

What is Debtor in Possession Financing?

Debtor in possession (DIP) financing is a form of specialized finance provided to a business that has filed for certain types of bankruptcy. It allows a financially distressed business to reorganize its operations and debts while continuing to operate as a going concern.

This financing is typically offered to businesses that can demonstrate a credible plan and willingness to turn themselves around and become solvent again, it’s not for those wanting to liquidate.

The term debtor in possession stems from the fact that after filing for bankruptcy, the existing management team or board of directors remain in possession of the business and are able to run the company as normal. However in the event that this is untenable through incompetence or otherwise, the creditors can request that the court appoint a trustee to take control.

Who Provides DIP Financing to Businesses?

There may be certain banks and traditional lenders that will sometimes offer DIP financing, however the primary sources for this type of finance are non-traditional, alternative lenders such as those that specialize in asset-based lending.

You will need to find a lender experienced and responsive in providing DIP finance as it can be complex and the nature of these situations dictates that it invariably needs to be set up very quickly.

Why do Businesses Need Debtor in Possession Financing?

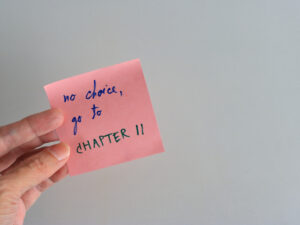

Businesses may seek DIP financing for several reasons, particularly when they are going through a Chapter 11 bankruptcy reorganization or have submitted a Notice of Intention (referred to as an NOI) under the Canadian Bankruptcy and Insolvency Act (BIA) or the Canadian Companies’ Creditors Arrangement Act (CCAA). These legal processes allow financially troubled organizations the opportunity to restructure their affairs whilst under bankruptcy protection. DIP financing serves as a crucial lifeline in these situations, providing the finance needed to emerge from a formal restructure as a viable ongoing concern.

Aside from salvaging a business, there are several reasons why an organization may approach the court to approve them seeking DIP finance. These reasons include;

Accessing Operating Capital

When a business files for Chapter 11 bankruptcy, it’s often facing a liquidity crisis that a new business plan won’t solve and more often than not, they’re not in any position to seek conventional finance. DIP financing provides the company with the necessary capital to continue its operations. This includes covering day-to-day expenses, paying employees and maintaining essential business functions. Once a business enters into a formal restructuring process, many suppliers will demand cash-on-delivery for supplies and DIP financing gives the business the funds needed to continue trading.

Preserving the Organization’s Value and Assets

DIP financing can help a business maintain its value and preserve its assets during the bankruptcy process. This is vital for maximizing the value of the business for stakeholders and creditors.

Attracting Investors

When investors see that a company has secured DIP financing, it shows that there is a detailed restructuring plan in place and this can make it more attractive to potential buyers or investors.

Retaining Control

DIP financing often involves strict terms and conditions and is subject to approval by the bankruptcy court. Although the financing comes with certain terms and covenants unique to the business, it can allow existing management to retain control over the business’s operations during the bankruptcy process which is an important aspect of a successful turnaround strategy.

Enhancing Creditor Payments

DIP financing increases the likelihood that unsecured creditors will recover a higher percentage of their claims since the business can continue operations and pursue a successful organization.

Enabling Payment of Priority Debts

It’s more likely that priority debts such as post-filing wages and critical vendor payments will be made as priority if a business can secure DIP finance. This ultimately can help build goodwill with creditors and maintain crucial relationships for the future.

Expediting Reorganization

The funds from DIP financing are typically used to support the company’s reorganization efforts. This can include investment into new business strategies, disposing of unprofitable assets and renegotiating contracts amongst many other strategies that enable the company to improve its long-term financial health.

What Sort of Businesses and Industries Qualify for DIP Financing?

DIP financing is primarily used by companies undergoing a specific type of bankruptcy; typically Chapter 11 in the US or equivalent applications through CCAA (larger corporations with in excess of $5 Million owing to creditors) and the BIA in Canada.

Large corporations with substantial assets may use DIP financing to protect valuable assets and fund more complex operations. These businesses may include retail chains, manufacturing, professional services, oil and gas and energy companies. Those businesses that are disproportionately impacted by economic downturns such as tourism and hospitality may also look to DIP financing to stay afloat during periods of reduced travel and the commercial real estate industry with significant holdings in property, can utilize debtor in possession financing to manage and protect their assets.

No matter the size of the company, businesses that use DIP financing are all typically in a distressed financial position, facing declining profitability and the inability to service heavy debt loads.

Whilst DIP financing can be used by any company and industry in theory, there are some circumstances when it might not be available nor suitable. Here are a few scenarios in which a business might face challenges or limitations when attempting to secure DIP financing;The term debtor in possession stems from the fact that after filing for bankruptcy, the existing management team or board of directors remain in possession of the business and are able to run the company as normal. However in the event that this is untenable through incompetence or otherwise, the creditors can request that the court appoint a trustee to take control.

- DIP lenders often require collateral or a security interest in the business’s assets to mitigate their risk. If a business lacks sufficient valuable assets to serve as collateral, they may find it difficult to secure financing;

- Lenders assess the likelihood of a successful turnaround for the business. If the business’s financial troubles are so severe that there is little chance of recovery or if the business model is fundamentally flawed, potential lenders may be reluctant to provide financing;

- The business will generally need enough cash flow to cover operating expenses and the DIP loan itself. If the business’s financial situation is such that it can’t generate enough cash flow to support its operations and service the DIP loan, financing can be unfeasible;

- DIP financing is often contingent on the business presenting a credible and comprehensive plan for reorganization. If the business doesn’t have a workable strategy to restructure and emerge from bankruptcy as a healthier entity, it may struggle to obtain DIP financing;

- If a business has extensive outstanding debt obligations, it may find it challenging to secure DIP financing, especially if it cannot demonstrate that it will have the capacity to repay the DIP loan while satisfying existing obligations to creditors;

- In some cases, existing creditors or stakeholders may oppose DIP financing because they believe it would undermine their interests or dilute their potential recovery. This can complicate the approval process in bankruptcy court;

- The availability of DIP financing can vary depending on market conditions and economic factors. In some situations, there may be a shortage of willing DIP lenders, making it difficult for businesses to secure financing;

- DIP financing often comes with stringent terms, covenants, and higher interest rates due to the increased risk associated with lending to a business in bankruptcy. Some businesses may find the terms of DIP financing to be too prohibitive;

- The business’s management and owners may object to DIP financing if they believe the terms and conditions imposed by the lender are too restrictive or would significantly dilute their ownership stakes.

- Occasionally, the management of a distressed business leaves that business prior to filing for bankruptcy and this can leave a gap in expertise, resources and support required to execute a successful turnaround. This situation may leave potential lenders reluctant to provide financing without an active and capable management team in place.

Ultimately, the feasibility of DIP financing for a specific business depends on the unique circumstances of that business and its ability to meet the requirements set by potential DIP lenders and the bankruptcy court.

If the business cannot access DIP finance, it may need to explore alternative strategies for managing their financial difficulties or consider other options, such as asset sales, liquidation, or a Chapter 7 bankruptcy filing.

Assess the Suitability of DIP Financing without Delay

Businesses must engage experienced legal and financial advisors when considering DIP financing. These professionals can help assess the business’ financial situation, determine whether bankruptcy is the appropriate path and support you in securing financing if needed.

Timing is crucial in a Chapter 11 or similar situation because it can impact the business’ ability to continue operating, protect its assets and emerge more financially sound from the restructuring process. Don’t wait for a default on significant obligations as creditor actions and related legal complications can make the process much more complex; DIP financing can help avoid this if secured early.

Accounts receivable finance is just one tool at the disposal of lenders through debtor in possession financing. During the bankruptcy process, invoice factoring can provide funding to the business based on the value of their unpaid invoices and the creditworthiness of their customers as opposed to their own credit standing.

Our Sallyport leadership team has decades of experience supporting businesses in complex turnaround and restructure circumstances. Even if you’ve already initiated bankruptcy proceedings, we may still be able to help – reach out without delay for more information – 832-939-9500.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Sallyport Commercial Finance, LLC – Meet Jamie

Jamie Simmons Senior Account Executive Sallyport Commercial Finance, LLC What advice would you offer to women just starting out in…

Read MoreRecycling Industry : From Niche to Mainstream

Awareness around environmental impact and prevention of climate change has really gathered pace over the past 40 years, shaping the…

Read MoreVideos