Articles & Videos

Commercial Real Estate Finance and the Prolonged Pandemic

Commercial real estate comprises very different economic sectors which have so far been very disparately impacted by the pandemic – retail, hotels and restaurants have had to withstand much more financial pressure than industrial or multi-family investments for example and then there’s the office sector which sits somewhere in-between in a state of limbo.

Some tenants will have struggled to make lease or mortgage payments as they’ve been repeatedly subjected to closures and restrictions, whilst other sectors of the CRE market may have been artificially buoyed by the continued federal government support propping up cash flow. Until we’re out of the uncertain phase, which seems more of a reality for the US than Canada currently, it’s difficult to understand what the lasting effects might be on commercial real estate finance.

Typically, when the economy is in a downturn, we don’t see defaults in CRE until 8-12 months following the start of any financial crisis, however the current recession is unlike any we’ve seen prior; not caused by an overheating of the economy and ensuing banking crises, but by a sudden and dramatic change in consumer behavior which led to high unemployment and GDP declines previously unheard of in such a short space of time. Additionally, economic stimulus has been provided at an unprecedented level which perhaps means that the fallout for commercial real estate finance has only been deferred further than it would be ordinarily.

What are the different scenarios panning out?

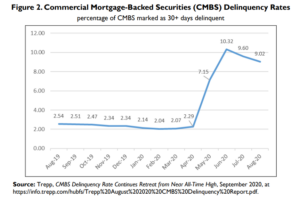

Delinquency rates peaked a few months after the pandemic starting around June 2020, largely driven by hotels and retail, however, they then started to decrease again as the initial shock of the decline subsided and some businesses were able to successfully adapt to new conditions. Now defaults are on the rise again.

Although the trends emerging in the early pandemic were expected to reverse going into a new norm, which would have seen CRE return to near normal relatively quickly, the market was not prepared for this crisis to linger as it has done. Malls have been closed more than open over the year, companies are preparing for permanently remote workforces and we’re certainly not welcoming tourists anytime soon to help ease the cash flow of struggling hotels and entertainment businesses.

As a worst case scenario, further and prolonged lockdown measures are needed to combat the pandemic and this causes a ripple effect on commercial real estate and potentially the macro-economy. As rental rates drop and property values start to decline, we could see the beginning of a sustained first wave of high delinquency rates, distress sales and foreclosures. This is a big concern for lenders that have considerable portfolios in the worst-affected areas of CRE.

Best and worst performing CRE sectors

Out of the four main asset classes in commercial real estate, two have taken a hit, one has remained fairly stable and one has outperformed them all.

Industrial use property is increasingly attractive to investors as the surge in e-commerce, home improvement and grocery delivery during the pandemic doesn’t seem to be losing any momentum just yet. The Canadian market benefitted from an increase in rents in the industrial sector, up by almost 10% YoY and US data centers and industrial spaces enjoyed funds from operation (FFO) growth of 11.2% and 18.1% respectively, YoY 2020.

Retail was far from buoyant prior to the pandemic and we won’t really know how that will play out until consumers decide whether to return to stores in droves or continue with some of the new ways of life we’ve come to accept. Looking at economies that are already back to some sense of normalcy, footfall levels have not returned to pre-pandemic levels overnight and are unlikely to. Right now, most are predicting rents will fall upwards of 10% for retail properties, maybe with the exception of grocery-anchored retail plazas which seem to weather a recession better. We may see retail properties evolve into more mixed-use spaces, using some of their space for warehousing additional inventory or creating mini-fulfilment centers closer to cities.

Office has been another loser in the CRE stakes with most companies discussing a modest reduction in the office space they plan to occupy post-pandemic, however any rent reduction is also expected to be modest as companies gradually bring back employees. The trend towards open-concept office layouts and large collaborative spaces has diminished through COVID so spaces will need to be re-imagined with health and safety in mind. Some tenants could look to use this opportunity to secure more premium premises at a discount, to the detriment of building owners with lower class commercial properties.

The multi-family asset has remained fairly resilient through the pandemic, maintaining its pre-pandemic position. Although some office workers may have migrated to suburbs in search of more space, affordable urban housing is still a core need for city workers. Immigrants also depend on rental accommodation on their arrival and with more progressive policies coming from the Biden administration and enormous quotas to hit in Canada, multi-family units will remain one of the more lucrative investment opportunities. In the longer-term, for those with strong balance sheets and access to capital, this sector appears to be a safe bet.

What’s left in reserve?

2021 looks like it will mirror the performance of 2020 so far, the big question is how much more is in reserve to sustain the worst affected sectors when reality sets in and no more funding is forthcoming?

Lenders will ultimately look to mitigate the risks posed to them from the changes in social behavior and preferences and structure their offerings very differently for the CRE finance sector. Unlike residential real estate, down payments for commercial projects usually fall between 60-75% LTV with shorter repayment terms and a bigger final payment.

Tightened lending could come in the form of higher down payments or shorter repayment terms and coupled with government support drying up, building owners may struggle to refinance or maintain enough working capital to meet their everyday obligations.

It’s unlikely that we’d see a repeat of the global crisis of 2008 as banks and lenders are not the same entities they once were. Having said that, banks now represent a higher share of the CRE debt market and will need to be assessing properties much more stringently for current and future scenarios including the possibility that those properties are no longer fit for the purpose they were intended.

As we do eventually emerge from the crisis, assessing portfolios for vulnerabilities and preparing for different eventualities can help to reduce exposure, both as a lender or property owner. If you have any questions on financing for commercial real estate or assistance in managing your working capital, please don’t hesitate to reach out to our team for assistance.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

How to Establish Business Credit for the First Time

Access to business credit can be a lifeline when businesses most need it, providing cash flow for payroll, purchase of…

Read MoreHow to Choose an Invoice Factoring Company

You’ve already done your research and invoice factoring seems to be the most suitable option for financing your business. Other…

Read MoreVideos

AG Machining Client Testimonial

AG Machining Client Testimonial

View NowPopkoffs Client Testimonial

Popkoffs Client Testimonial

View Now