Articles & Videos

Canadian Labour Market Stalls: A Concern for Businesses?

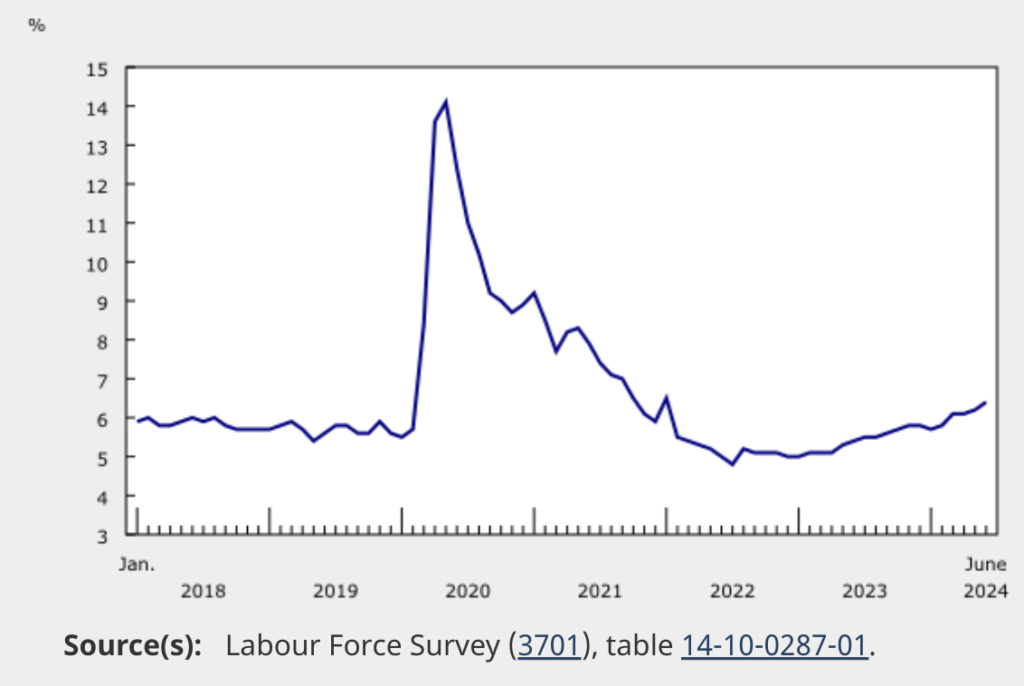

In June 2024, the Canadian labour market witnessed a surprising development with the loss of 1,400 jobs, marking a rare contraction to a trend of adding to the number of employed since around February 2023.. This minor but significant decline has raised concerns among Canadian businesses, entrepreneurs and policymakers, signaling potential shifts in the economic landscape that could have broader implications.

Source: Labour Force Survey, June 2024.

The Context Behind the Numbers

Canada’s job market has generally shown resilience, with unemployment rates hovering near historical lows. The sudden drop in employment figures, albeit modest, comes as a deviation from the usual trend of job creation. This downturn has sparked discussions about the underlying factors that could have contributed to this anomaly.

Several sectors in Canada have faced challenges recently. The technology and natural resources sectors, significant pillars of the Canadian economy, have been particularly volatile. The tech sector has experienced layoffs due to a global recalibration after the post-pandemic boom and the energy sector has grappled with fluctuating oil prices and regulatory uncertainties. Additionally, the manufacturing sector, another cornerstone of the economy, has felt the pinch from ongoing supply chain disruptions and changing trade dynamics.

Moreover, interest rate hikes by the Bank of Canada aimed at curbing inflation may also be playing a role. Higher borrowing costs can slow down economic activity as businesses become more cautious about expanding and hiring and consumers may reduce spending adding to businesses revenue troubles. The cumulative effect of these factors can contribute to a weakened labour market.

Labour Market Impact on Canadian Businesses

For Canadian businesses, the decline in job numbers could signal several potential issues and necessitate strategic adjustments.

- Caution in Expansion and Investment: Businesses might adopt a wait-and-see approach, delaying expansion plans and investments. This cautious stance could stem from concerns about consumer demand, particularly if the job losses signal a broader economic slowdown. Companies might also be wary of taking on new debt or financing due to higher interest rates.

- Talent Management: In sectors experiencing layoffs, businesses might find an opportunity to acquire talent that is suddenly available. Conversely, industries that remain strong may face increased competition for skilled workers, driving up wages and operational costs.

- Operational Adjustments: Companies may need to re-evaluate their operational strategies. For instance, firms could focus on improving efficiency and productivity to maintain profitability in a more uncertain economic environment. This might involve investing in technology and automation to reduce dependency on labor, especially in sectors where finding skilled workers is becoming challenging.

- Consumer Behavior: If job losses lead to lower consumer confidence, businesses in retail and services might experience reduced demand. This could prompt companies to offer promotions or adjust their pricing strategies to attract cautious consumers. Understanding and adapting to shifts in consumer behavior will be crucial for maintaining sales and market share.

Labour Market Implications for Entrepreneurs

Entrepreneurs, particularly those in the early stages of their ventures, might feel the impact of job losses and economic uncertainties even more acutely.

- Access to Capital: New businesses often rely on external funding, which can become more difficult to secure in a climate of economic uncertainty and higher interest rates. Investors may become more risk-averse, and lending institutions might tighten their criteria for providing loans. This can hinder the growth prospects for startups and small businesses, necessitating more creative financing solutions or bootstrapping strategies.

- Market Opportunities: Economic shifts can open up new opportunities for entrepreneurs who can adapt quickly. For example, businesses that offer cost-saving solutions, cater to evolving consumer needs, or innovate in disrupted sectors might find new growth avenues. Entrepreneurs who can pivot or leverage emerging trends will be better positioned to thrive.

- Operational Challenges: Startups and small businesses might need to focus on maintaining lean operations to navigate uncertain times. This could involve cost-cutting measures, streamlining processes, and finding ways to do more with less. Flexibility and agility will be key traits for entrepreneurial success in a volatile market.

- Workforce Dynamics: Entrepreneurs could benefit from a more dynamic labor market where skilled workers are seeking new opportunities. However, they will also need to compete with established companies for top talent. Offering unique value propositions, such as flexible work arrangements or equity stakes, could help attract and retain employees.

The Road Ahead

The June 2024 job losses, while seemingly minor, could be an early indicator of more significant shifts in the Canadian economy. Businesses and entrepreneurs need to remain vigilant and adaptable as they navigate these changes. Monitoring economic indicators, staying informed about industry trends, and being ready to pivot will be crucial strategies for success. The labour market is a key signal informing the Bank of Canada’s decision on interest rates; with their next decision due on July 24th, this job market news may encourage another interest rate cut.

In this respect, policymakers, too, will have a role to play in fostering a conducive environment for economic stability and growth. Measures to support sectors in transition, enhance workforce skills, and provide financial stability can help mitigate the impact of job losses and promote a resilient economy.

Ultimately, while the loss of 1,400 jobs is a small blip in the larger economic picture, it serves as a reminder of the interconnectedness of economic factors and the need for proactive responses from all stakeholders in the Canadian economy.

Whatever the road ahead, Sallyport is committed to the support of business owners and entrepreneurs in their efforts for growth. If you’re finding it difficult to access the finance you need at the current time, please reach out to our experienced team for guidance.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Financial Brokers and Alternative Finance: Fostering Business Growth

The financial landscape has witnessed a paradigm shift with the emergence of multiple alternative finance providers over the past decades.…

Read MoreHow to Qualify for Invoice Factoring

Steady, predictable cash flow is the main reason businesses use accounts receivable financing but if you’ve never done it before,…

Read MoreVideos

American Business Women’s Day

Sallyport Commercial Finance Celebrates American Business Women’s Day

View Now