Articles & Videos

Canadian Labour Market Defies Expectations – What Next for Businesses?

Statistics Canada recently published their monthly labour force survey which showed unemployment held steady at 5% in January. That figure doesn’t say much in itself but underlying that stat is the fact that 150,000 jobs were added to the economy, instead of the 5000 that were predicted by RBC. As the labour market defies everyone’s expectations as the start of the year, the report has economists at odds as to what these latest figures mean for the Canadian economy and for businesses going forward.

Strongest Job Growth in Canada for Almost a Year

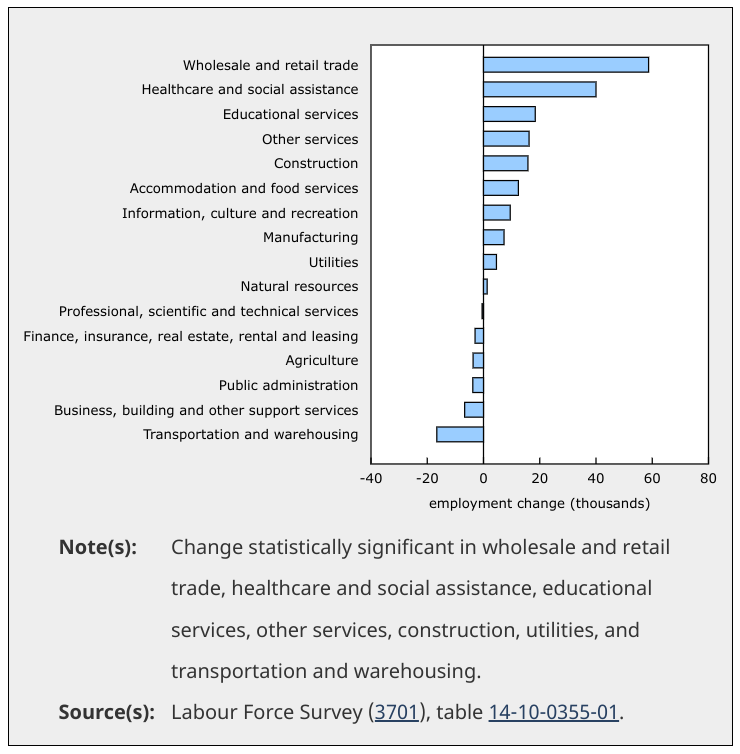

Employment gains were spread across five provinces with Ontario and Quebec registering the largest increases at 63,000 and 47,000 jobs respectively; the only small decline was seen in Newfoundland and Labrador, but this may be balanced by their December gain. Jobs also increased across a number of varied industries, however wholesale and retail trade and healthcare showed significant gains. The core-aged employment group, those aged 25-54 accounted for the lion’s share of jobs added and the proportion of the working-age population who are in the labour market, either employed or looking for work (labour market participation rate) actually grew 0.3% to 65.7%.

The figures represent the strongest job growth in Canada since February 2022, flying in the face of expectations that the labour market would start to dwindle in early 2023. Interest rates have been pushed from 0.5% in March to 4.5% in January 2023 following government policy to bring inflation under control by increasing the base rate a total of 8 times. The general economic expectation is that we would start to see the impact of those interest rate hikes in a falling employment rate as the economy stalls, businesses start to feel the pinch and post less and less vacancies. In reality, it appears that many sectors are still hiring and bucking the trend, at least for now.

What Does a Strong Labour Market Signal?

Businesses already struggling with interest rate hikes are considering what this all means for further decisions by the Bank of Canada (BoC). The next announcement is coming March 8 2023 and many are wondering if rates will hold steady given the strength of the jobs market. BoC governor Tiff Macklem already indicated in early February that there would be a pause in rate hikes, despite the January jobs report because the signs were good that inflation was decelerating. He defended this position speaking to the time it takes for rate hikes to show an impact on the economy saying…

“Typically we don’t see the full effects of changes in our overnight rate for 18 to 24 months. We shouldn’t keep raising rates until inflation is back to 2 per cent. Instead, we need to pause rate hikes before we slow the economy and inflation too much.”

The bank also looks to the housing market as a key indicator in setting monetary policy and with home sales down over 38% in November 2022 year on year and average sale prices declining 12% over the same period, higher borrowing costs have certainly cooled the market and reigned in spending on big-ticket items.

Homeowners and commercial property owners will be refinancing at potentially higher rates in 2023, which will inevitably result in less spending on discretionary items or in the case of businesses, less new hires. The BoC has a very difficult balance to strike, if rates are paused and wage growth continues to fuel inflation, further rises will be necessary which could possibly lead to a much more severe recession. If the signs are right however, we’d expect to see moderate growth in Canada’s economy this quarter, perhaps a milder than anticipated recession over the next two quarters, resurging somewhat towards the end of the year. Any reductions in interest rate would likely not happen until early 2024 and we wouldn’t rule out the possibility of another quarter point increase in April should the labour market prove unshakable.

Although we continue to hear about big tech-companies and startups making redundancies, the government’s policy on immigration, welcoming more skilled workers than ever before, may have helped to prop up the labour market to some extent during the latter part of 2022. The plans to welcome 465,000 new permanent residents during 2023 could go some way to easing labour supply and stabilizing wage growth which may be a way to avoid further rate hikes.

What’s the Outlook for Canadian Business Owners for the Rest of 2023?

It’s fair to say the start of 2023 has proved a mixed bag for business owners. Although forecasters predict that prices will broadly start to come down as supply chain challenges continue to recede, business owners are still concerned and expect they will perform either the same or worse than 2022. The Canadian Federation of Independent Businesses (CFIB) business barometer for February suggests most businesses are pessimistic about the outlook for the remainder of the year and also in a precarious financial position, over half still carrying pandemic debt and troubled as to how they would meet rising expenditures, most of which are still on an upwards trend.

Of the businesses surveyed, 38% are now stating borrowing costs as a challenge which is double that of 12 months prior and they cite struggling to cover costs of production; energy, wage, insurance and product input costs were all mentioned by businesses in the CFIB report as being above their historical averages.

Consumers will also be put under further financial distress as we move into the second quarter, business owners are quite rightly anxious about also maintaining revenue in parallel with rising costs. Without any obvious assistance forthcoming from the government in terms of extended payment terms for COVID-related loans, many will be considering the viability of business moving forward.

The February labour market report should become available towards the middle of March and we’ll be waiting expectantly for indications of improving conditions for SMEs in Canada. Our experienced team works with businesses from all kinds of industries who are contending with challenging market and economic conditions. Reach out today for further details on how our tailored financial solutions may alleviate pressure on your cash flow while you weather the storm.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Canadian Business and The 2022 Federal Budget – Key Takeaways

It’s fair to say small businesses didn’t feature massively in the Canadian 2022 Federal Budget proposed last week. Although there…

Read MoreCanada Makes First Move on Interest Rate: What Now for SMEs?

The Canadian interest rate cut on June 5th, 2024, marks a significant policy shift with broad implications for the economy,…

Read MoreVideos

American Business Women’s Day

Sallyport Commercial Finance Celebrates American Business Women’s Day

View NowAG Machining Client Testimonial

AG Machining Client Testimonial

View Now