Articles & Videos

Canadian Business and The 2022 Federal Budget – Key Takeaways

It’s fair to say small businesses didn’t feature massively in the Canadian 2022 Federal Budget proposed last week. Although there were a handful of measures aimed solely at business, much of the focus was on individuals, families and affordability as well as incremental spending on defense.

Ultimately though, many of the proposals impacting individuals also impact SMEs and as such we want to highlight those elements that are likely to have a wider effect and provide some perspective on where we see the Canadian economy heading as a result. Here’s our key takeaways from Budget 2022 : “A Plan to Grow Our Economy and Make LIfe More Affordable”.

Proposals for Businesses

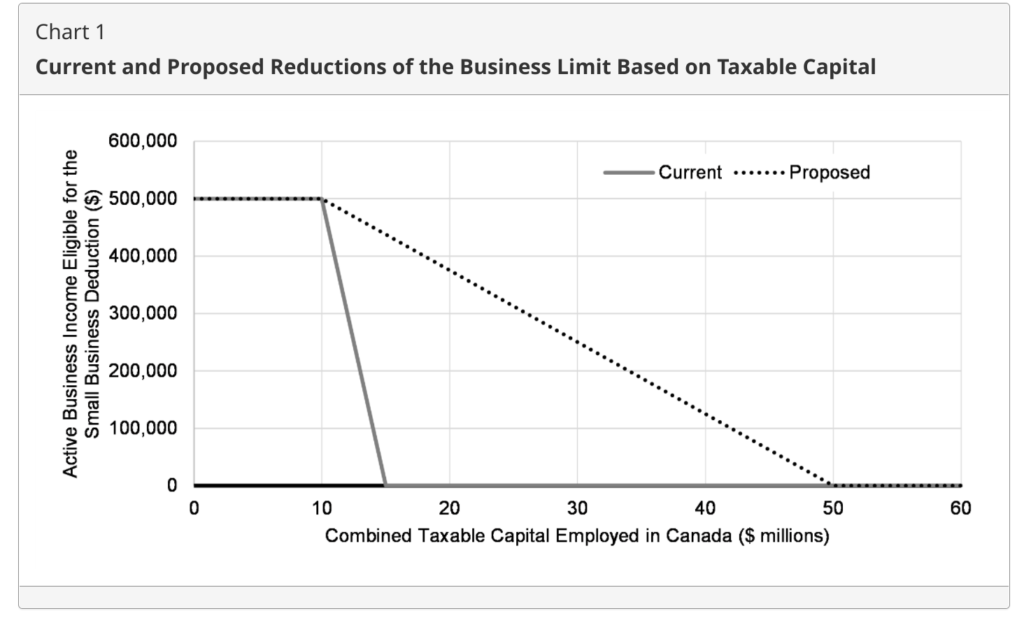

Amendment to the Small Business Tax Rate

An idea that’s been mooted for some time is making the lower small business tax rate accessible to more businesses by extending the taxable capital threshold. Currently the lower 9% tax rate is applicable until taxable capital reaches $15,000,000 at which point the general rate of 15% kicks in. Under the new proposals, businesses would see that threshold raised to $50,000,000, gradually phasing out access to the small business tax rate between $10-50 million and allowing more SMEs to fund growth and attract commercial investment.

Source: Budget.gc.ca. Accessed: 11-04-2022.

One-time Bank Tax

Minister Freelands’ proposal intends to impose a one-time Canada Recovery Dividend (CRD) on banks and life insurer groups with over $1 billion in taxable profits in 2021. The tax would be payable across five years, beginning 2022 and will generate around $2.06 billion in revenue for the government – critics and banking industry leaders were quick to state that this revenue is drastically scaled-back at less than half of what was first tabled during the election campaign and will hurt the economy more than it helps, sending out a signal that Canada is closed to investment.

Increase to Corporate Income Tax Rate for Banks and Other Financial Institutions

An increase of 1.5% is proposed to the current federal corporate income tax rate of banks and life insurance groups with group income of over $100 million. Whilst there had been talk of a 3% increase, this move will see the rate increase from 15% to 16.5%.

Action on Credit Card Transaction Fees Ongoing

A big area for concern for small businesses in particular, are the increasing fees that must be paid on customer credit card purchases. Canadian processing fees are among the highest in the world and as more and more business is transacted this way, this presents a growing concern for SMEs that don’t have the bargaining power to negotiate rates. Government consultations on this subject have been ongoing since August 2021, however the 2022 budget gave no further assurance to business owners that this was in-hand, only that consultations would be ongoing.

Investment Tax Credit for Purchasing and Installation of Eligible CO2 Equipment

The carbon capture, utilization and storage (CCUS) tax credit proposes a business tax credit for those incurring costs in the purchasing and installation of CCUS equipment. Credit rates under this proposal would run on a scale based on eligible expenses incurred between 2021 and 2040.

Boost for Canadian Innovation

$1 billion has been earmarked for investment into an independent innovation and investment agency to create a strategy which allows Canada to compete with the most innovative companies around the globe, attracting investment from high-tech, high growth companies and creating jobs and resilience for the future. It’s a case of ‘watch this space’ for new incentives and benefits that will emerge for Startups and entrepreneurs in growing tech industries.

Proposals for Individuals

Many of the proposals for individuals relate to housing and cost of living, with measures to help first-time home buyers, families and mobilize labor.

Home Buyers’ Tax Credit (HBTC)

The budget proposes to double the HBTC to $10,000, which would also double the amount of tax relief available on the purchase of a qualifying home from $750 to $1,500 in total. The credit is available to first-time home buyers, defined as those who have not owned nor lived in another in the calendar year of purchase or in the four calendar years preceding.

Multi-generational Home Renovation Tax Credit

This new tax credit will allow up to 15% of up to $50,000 to be claimed on qualifying home renovations which create a secondary dwelling unit for a senior or disabled family member.

Tax-Free First Home Savings Account (FHSA)

The newly-proposed FHSA provides first-time home buyers with a tax-free savings account with which they can save up to $8,000 per year or $40,000 over a lifetime, tax-free towards the purchase of a first home.

Home Accessibility Tax Credit (HATC)

In an effort to assist disabled and senior people to live more independently, the budget proposed a doubling of the HATC from $10,000 to $20,000 to enable home renovation or alteration that enhances accessibility for a qualifying individual.

Changes to Residential Property Flipping Rules

Income from residential properties that are ‘flipped’ purely for profit should be subject to full taxation and new proposals seek to ensure that income gained this way, on properties that have been owned for less than twelve months will not be eligible for 50% capital gains exclusion rate nor principal residence exemption (notwithstanding specific life event exemptions).

Ban on Canadian Property Ownership by Non-Residents

The 2022 budget proposes a ban on property ownership by non-Canadian commercial entities or individuals for two years. Few exemptions would apply to this ban and outside of this period, most purchases by non-residents in Ontario would be subject to the Non-Resident Speculation Tax (NRST), which was increased from 15% to 20% at the end of March 2022 on all purchases of residential property in the Greater Golden Horseshoe region.

Subsidized Child Care

The budget confirmed plans to press ahead with investments in child care, with the aim of achieving an average $10 per day for all regulated child care spaces by 2025-26 across Canada. Child care is a particular focus as the government aims to attract women disproportionately affected by the pandemic, back into the workforce and ease the labor shortages impacting various industries.

Dental Care for Low Income Families

Dental care will be provided to all families with an income of less than $90,000 with no co-payments required at all for families with an income of less than $70,000. These proposals will roll out to the under 12’s in 2022, under 18’s, seniors and disabled persons in 2023 and will be fully implemented by 2025.

Tax Deduction for Tradespeople

The budget proposes a tax deduction of $4,000 per year for eligible tradespeople and apprentices who have to travel or temporarily relocate for jobs.

Breaking Down Barriers for Healthcare Professionals

Many foreign-trained healthcare professionals were prevented from filling in the gaps in Canada’s health care system during the pandemic due to lack of recognition of their foreign credentials. The budget proposes to expand upon the program to have foreign health care credentials recognized and support up to 11,000 professionals to find work in Canada.

Conclusion

The 2022 budget points largely to the government’s perception of inflation as a significant economic threat with proposed spending coming in much lower than anticipated. We would also suggest that inflation and Bank of Canada policy to control it, continue to be the biggest threats to business in 2022 and beyond. Although the budget quite rightly recognized that plans need to be put in place for long-term prosperity, businesses need relief now.

The budget itself is unlikely to add any further heat to the economy, prices will continue on an upward trend in the near-term, driven by Russia’s invasion of Ukraine, spiraling commodity prices and uncertainty in China putting extraordinary pressure on global supply chains and freight costs. SMEs are facing increased costs from every angle at a time when all pandemic-related support has been withdrawn. There was nothing in the budget to prioritize the recovery of SMEs, indeed some costs have been imposed by the government including recent hikes to payroll and carbon taxes. As these businesses struggle to absorb costs, pay back higher-interest debt and maintain profitability, they will have no choice but to pass higher prices onto consumers, further inflaming prices.

Canada’s 2022 GDP may well hit the somewhat bullish estimates of 4% as consumers and individuals return to ‘business as normal’, however we would suggest the economy will grow slightly more moderately than this in the face of interest rate hikes and belt-tightening and then grow at a slower pace again during 2023.

For more insight on how business may be impacted by the 2022 federal budget, reach out to our Canadian team.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Equipment Financing for Startups- The Lowdown

Equipment financing refers to finance that is used to loan or lease a tangible business asset other than real estate.…

Read MoreWhat to Do When the Bank Says No : Alternative Business Funding Sources

Obtaining bank financing has always been difficult for certain businesses and the current economic environment is making it even more…

Read MoreVideos

American Business Women’s Day

Sallyport Commercial Finance Celebrates American Business Women’s Day

View NowWhat is Factoring?

Here we explain what exactly factoring is and how we can help your cash flow…

View Now