Articles & Videos

Adapting Business for the New Normal

Small businesses have an instinctive ability to be able to adapt to changing economic and market conditions and at no time has that agility and determination been more necessary than during the unforeseeable trading conditions of recent.

As the pandemic unfolded, companies were required to deal with forced closures,something that 65% of SMB leaders said threatened the viability of their business, or they saw increased costs to implement safety measures. For many it meant a swift pivot in their operations to accommodate customers, remote-working employees and the embracing of new technologies to shift from in-person to virtual interactions in every area of business.

Despite the initial pressures from responding to the pandemic and the ongoing challenges still being faced, businesses remain optimistic for the future. Many are preparing for the new normal we see emerging rather than waiting for the old to return.

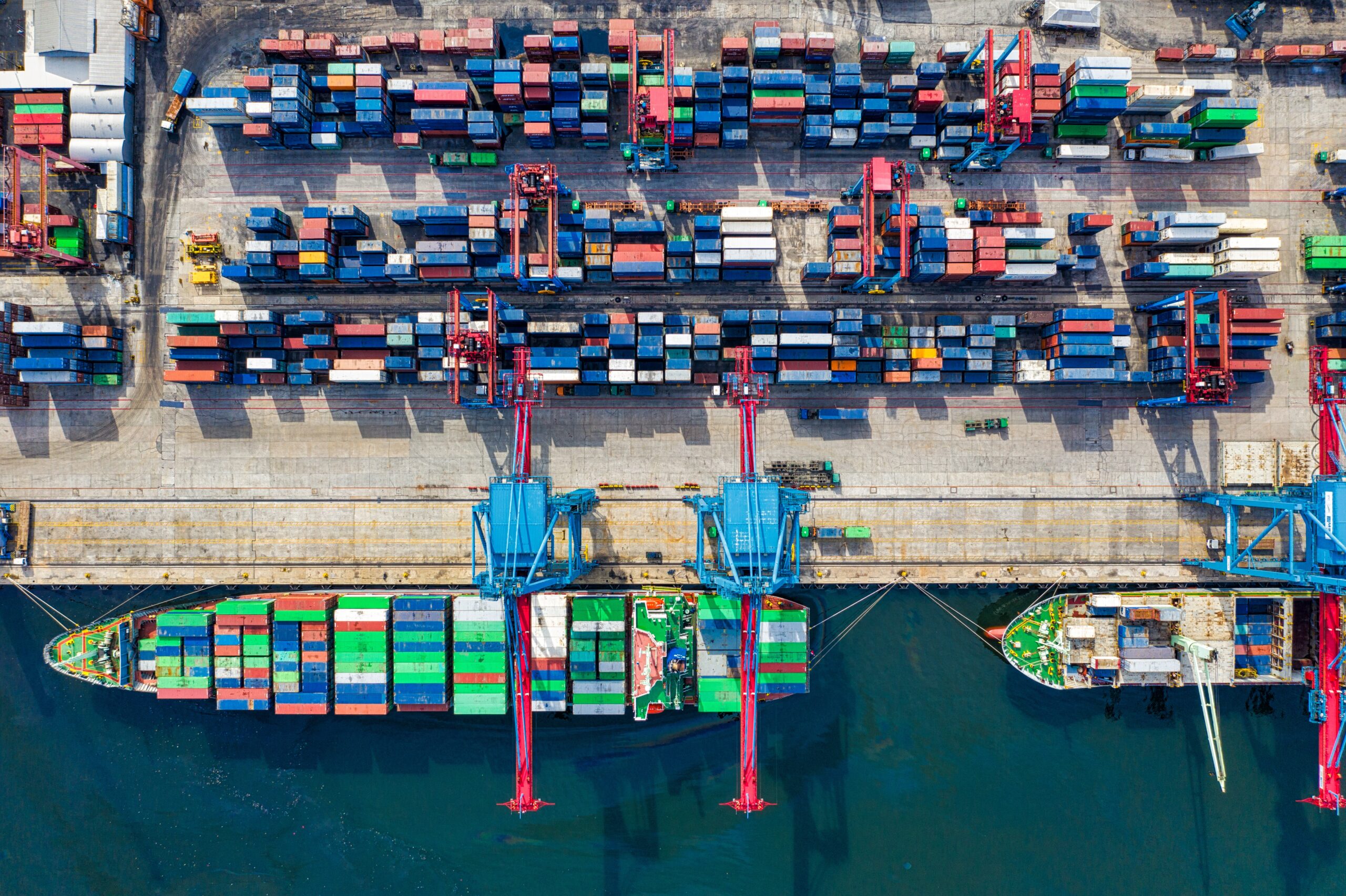

Evaluating supply chain and sourcing strategies

China accounted for over 28% of global manufacturing output in 2019, so when the virus hit and manufacturing shut its doors, global supply chains were sent into disarray. For lots of companies, products coming from their tier 1 and 2 suppliers dried up completely.

Food and beverage manufacturers were some of the worst affected through supply chain disruptions, struggling with lack of supply and a complete about-turn from more profitable business to lower-margins as consumers stayed at home.

Some probably looked on this as a temporary hurdle, for others it highlighted the risk of reliance on one or two big suppliers. Those wanting to add a level of resiliency for the longer-term may have already reviewed or be in the process of reviewing their supply chain to identify how they might be less reliant on one or two big suppliers. Seeking backup suppliers, spreading large contracts between multiple suppliers and looking for suppliers in different locations can all help to minimize risk to the business.

Things will likely settle down again but the covid-induced ‘new normal’ is to think and prepare for the worst-case-scenario. That means at least a discussion on plan B for more localized supply and production and probably a wider debate on cost Vs resilience.

Adapting and diversifying business models

It wasn’t only the supply chain that was disrupted by the pandemic. Consumer behaviours, inextricably linked with demand, changed overnight and businesses had to quickly reassess how they could carry on servicing customers or change their offerings in some way.

Initially businesses went into survival mode, looking at how they could adapt to make up lost revenue. This differs by industry but some actions might have included;

- Creating an online presence or advancing of existing digital channels to enable a switch to virtual-only services and selling and as a means of communicating with customers;

- Extending working hours to serve more customers, changing shift patterns or introducing shifts to accommodate the capacity restrictions on workplaces; or offering increased access to customer services;

- Diversifying products and services to take advantage of new opportunities – manufacturers utilizing their facilities to produce new in-demand products such as PPE masks and sanitizer for example;

- Rationalizing product ranges to focus on fewer things that could be executed better.

Just as these 19 businesses from around the world pivoted to adapt to a new norm, all kinds of businesses were spurred on to find new ways of being. This type of business agility is expected to outlive the pandemic as complex processes for business change gave way to more streamlined ways of working.

Most sources say there will never be a return to the ways we did business pre-pandemic, therefore adapting business models around new growth opportunities will be crucial in the new normal.

Digital Innovation

Digital transformation was already happening pre-pandemic but businesses had to expedite the adoption of a ‘digital-first’ philosophy if they wanted to survive. Taking advantage of digital technologies meant they could keep communicating with customers and prospects in different ways and support remote-working employees with video-conferencing, collaboration and other cloud software.

Once those basic needs were addressed, many started to identify other practices that just wouldn’t work in the new normal. Not being able to network face-to-face with customers and prospects elevated the need to communicate in a more personalized way – investing in customer management software allows for the tapping into data and analytics that wasn’t previously accessible. For other companies, investment in automation technologies became a big factor in reducing human intervention and in the manufacturing industry, full automation is now much closer than anyone thought.

What’s evident is that the pandemic has changed the mindset of business owners forever; digital technology is no longer about saving the company money, it’s become the entire focus of the business in gaining competitive advantage.

Capital considerations

For many companies the pandemic has so far caused a bottleneck in their cash flow and this understandably leads to the delaying of all capital expenditure. This might not be the best option for everyone, because avoiding expenses completely can put them in a tricky position as the economy starts to recover. They could then find that they’re not as capable of taking advantage of the upturn as their competitors who reallocated investment into areas of growth.

Coming out of the crisis it would be sensible to plan for increases in costs that may well be levied by the government, utility companies and other suppliers who attempt to claw back their own lost revenues. Couple this with a sustained period of economic downturn and cash flow can become a major concern.

Access to capital is still the biggest concern for SMEs, two-thirds of whom say that they have insufficient funds to support business recovery according to a report by the International Labour Organization. Striking a balance between investment and positive cash flow is a difficult but essential task for businesses to be able to weather the storm.

Building on the positives

There’s no doubt that the pandemic continues to present a tough environment for any business, yet many continue to adapt and thrive.

We’re moving out of the hugely disruptive phase of the pandemic to the new normal for business. It’s important to recognize which of the impacts of COVID-19 are short-term and which are here to stay so that sound business decisions can be made.

Those companies that can maintain a positive liquidity position whilst maximizing on those opportunities that are here to stay, will be able to drive growth and emerge even stronger into the new era.

For advice on alternative funding options at this time, reach out to our specialist team who would be happy to help.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

5 Growth Stages of Business and How to Finance Them

It doesn’t matter whether you’re in manufacturing or staffing, have one or fifty employees; the growth stages of business look…

Read MoreMerchant Cash Advance (MCA) – Bad for Business?

Both new and established businesses can suffer from cash flow problems occasionally and need to access funding to help them…

Read MoreVideos

AG Machining Client Testimonial

AG Machining Client Testimonial

View NowWhat is Factoring?

Here we explain what exactly factoring is and how we can help your cash flow…

View Now