Articles & Videos

A Guide to Accounting for Factored Receivables (inc Example)

When you begin invoice factoring, your invoices are transferred to the factoring company for collection and they cease to be a debt (or liability) on your balance sheet. Accounting for factored receivables involves different treatment to a traditional bank loan as these two financing arrangements have distinct characteristics and implications for the business’ financial statements.

Differences in Accounting for Factored Receivables Vs Bank Loan

Some of the main differences in accounting for factored receivables lie in the nature of the transaction, how risk is allocated, balance sheet impact, repayment structure and the treatment of fees and interest charges.

Nature of the Transaction

Factoring is the sale of accounts receivable to a third-party company (the factor) for a fee. It’s a transaction where the company is converting unpaid invoices into immediate cash and the factor then assumes responsibility for collecting the outstanding invoices from the customers.

A bank loan is a borrowing arrangement where a company borrows money from a bank or financial institution typically with the intention of repaying the principal amount borrowed along with interest over a specified period.

Balance Sheet Impact

Factoring transactions impact the balance sheet by reducing the accounts receivable balance and increasing the company’s cash balance. The factored receivables are removed from the assets section because they have been sold to the factor. Conversely, bank loans increase the cash (bank) balance on the assets side but they also create a liability on the company’s balance sheet. The borrowed amount is recorded as a long-term or short-term liability, depending on the repayment terms of the loan.

Repayment Structure

Because factoring involves the sale of receivables, there is no repayment in the traditional sense; the responsibility for collecting payments now lies with the factoring company. Bank loans have scheduled repayment plans and the borrowing company is required to make periodic payments, which usually include both the interest and part of the principal amount, until the loan is fully repaid.

Risk and Recourse

In non-recourse factoring, the factor assumes the risk of non-payment by customers and the business selling their invoices won’t be liable if their customers fail to pay. In recourse factoring, the business retains the risk and may be obligated to buy back the receivables if customers do not pay within a specified period.

In the case of a traditional bank loan, the business borrower will always bear the risk of loan default and if they fail to make loan payments, they may face penalties, impaired credit rating and legal action by the lender.

Recognition of Interest and Fees

When you factor invoices, a fee is paid to the factor for providing this service. This fee is treated as an expense as opposed to being considered interest as it would be on a bank loan. Factoring fees would usually be recorded as a factoring expense. Interest on a bank loan would be recorded as an expense over the loan term; this would be recognized in the income statement and reduces the company’s net income.

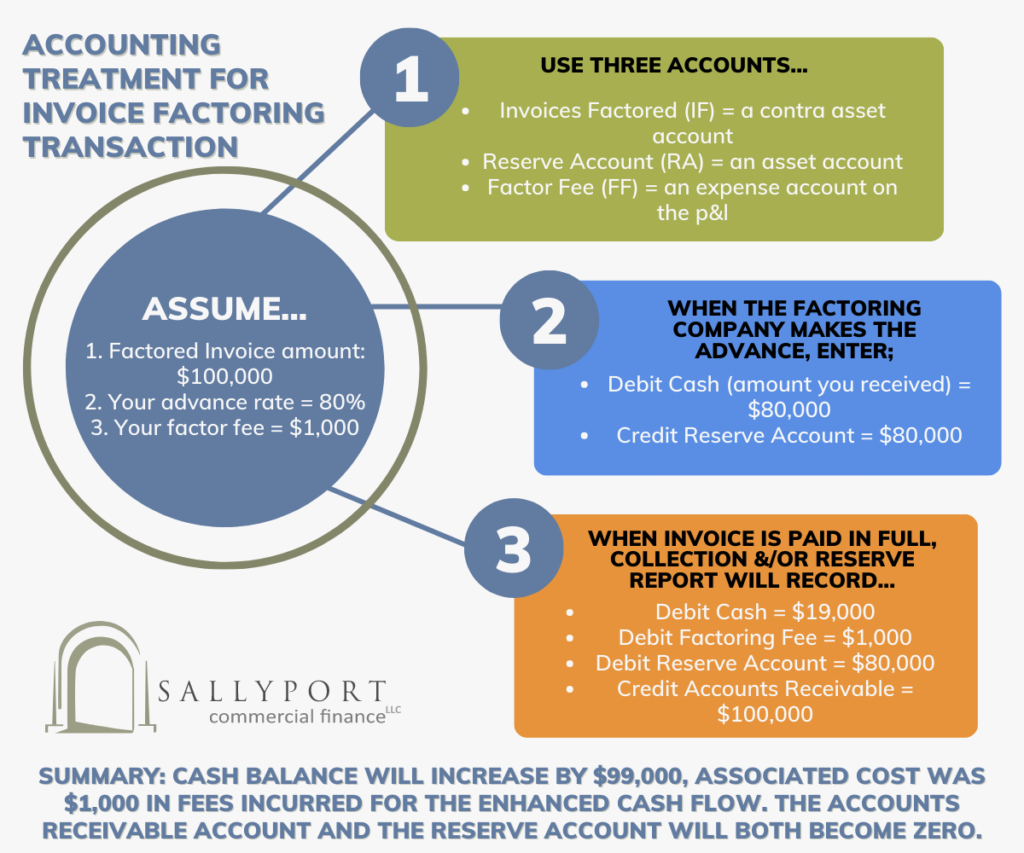

Steps to Accounting for Factoring Receivables

Before entering into a factoring arrangement it’s essential for a business to understand their obligations related to financial records and reporting. We would always recommend consulting your accountant or financial advisor to ensure compliance with accounting standards in your particular region,however here are some general steps to guide the accounting treatment for invoice factoring.

Initial Factoring Transaction

When you sell your invoices to the factor, you receive immediate cash but that transaction must be recorded somewhere on your books. The accounting entries depend on whether the factoring is done with or without recourse.

- Without Recourse: In this case, the factor assumes the risk of non-payment and you have no obligation to buy back the invoices if they remain unpaid.

Debit: Cash (the amount received from the factor)

Credit: Accounts Receivable (the total value of the invoices sold)

- With Recourse: If the factoring is done with recourse, you retain some risk and you may be required to buy back the invoices if your customers don’t pay within a specified period.

Debit: Cash (the amount received from the factor

Credit: Accounts Receivable (the total value of the invoices sold)

Credit: Recourse Liability (the estimated amount of potential buyback)

Factoring Fee

The factor charges a fee for providing the service, which is typically a percentage of the total value of the factored invoices. This fee is an expense for your business.

Debit: Factoring Expense (or a similar account)

Credit: Cash (payment made to the factor for the factoring fee)

Collections from Customers

As your customers remit payment for their invoices, you will need to record the collections. As the invoices have already been sold to the factor, you should not recognize them as revenue.

Debit: Cash (amount received from customers)

Credit: Accounts Receivable (to reduce the accounts receivable balance)

Handling Recourse Liabilities (If Applicable)

If the factoring agreement is a recourse-type arrangement and some invoices remain unpaid after the contractual period, you’ll likely need to purchase them back from the factor. The liability for any potential buyback will need to be shown as an adjustment as necessary.

Debit: Recourse Liability (to reduce the liability)

Credit: Cash (payment made to the factor for the buyback)Accounting Tools provides a useful illustration of the potential journal entries that may be made when selling your account receivables and here’s our example accounting treatment for a simple factoring transaction…

Maintaining clear and accurate records of all the factoring transactions will ensure proper financial reporting and regulatory compliance. It’s important to note that accounting practices can vary depending on the accounting standards applicable to your business or industry.

Straightforward Receivables Accounting Treatment

The key accounting entries for factoring are typically very straightforward; records are made for cash received, reductions to accounts receivable balance and accounting for any factoring fees or recourse liabilities. A simpler transaction results in less complexity in accounting compared to a traditional loan for example.

Overall bank loans require more complex accounting due to the accrual of interest which demands expertise in loan terms and accrual accounting. Some loans will also have collateral requirements and loan covenants that need to be accounted for over the term of the agreement and this can have a longer-term impact on a business’ financial statements.

With fewer financial instruments needed and no debt added to the balance sheet, invoice factoring can be the ideal solution for businesses looking for a short-term financing option that reduces ongoing accounting complexities.

Our team is more than happy to help with any questions you might have on getting started with invoice factoring or accounting for factored receivables – reach out today.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Financing a Business Restructure and Turnaround

Financing a business restructure is one of many reasons a business may need to supplement their finances. Restructuring is usually…

Read MoreUnderstanding Business Acquisition Financing

At the simplest level, business acquisition financing is the capital that needs to be obtained for a company to purchase…

Read MoreVideos

AG Machining Client Testimonial

AG Machining Client Testimonial

View Now