Newsroom

Sallyport Commercial Finance Welcomes William Garcia

Sallyport Commercial Finance Welcomes William Garcia

Sallyport Commercial Finance expands their Underwriting department by hiring William Garcia as Underwriting Analyst.

William Garcia born in Southern California, holds a (BS) in Finance from California State University, Chico. He brings experience from multiple summer internships in the factoring/asset-based lending industry working in both Operations and Underwriting. William has recently relocated from Southern California to Houston, Texas to assist in Underwriting at Sallyport’s corporate office.

“I am delighted to have William join our Underwriting team. Our ability to attract and develop new talent entering the finance industry is key to our long-term growth and aspirations. We are excited to have William begin his career in finance with Sallyport Commercial Finance with his can-do attitude and strong work ethic, we believe William has all the tools needed to be successful and develop a strong career in Commercial Finance.” – Damon Dickens, VP, Risk and Underwriting.

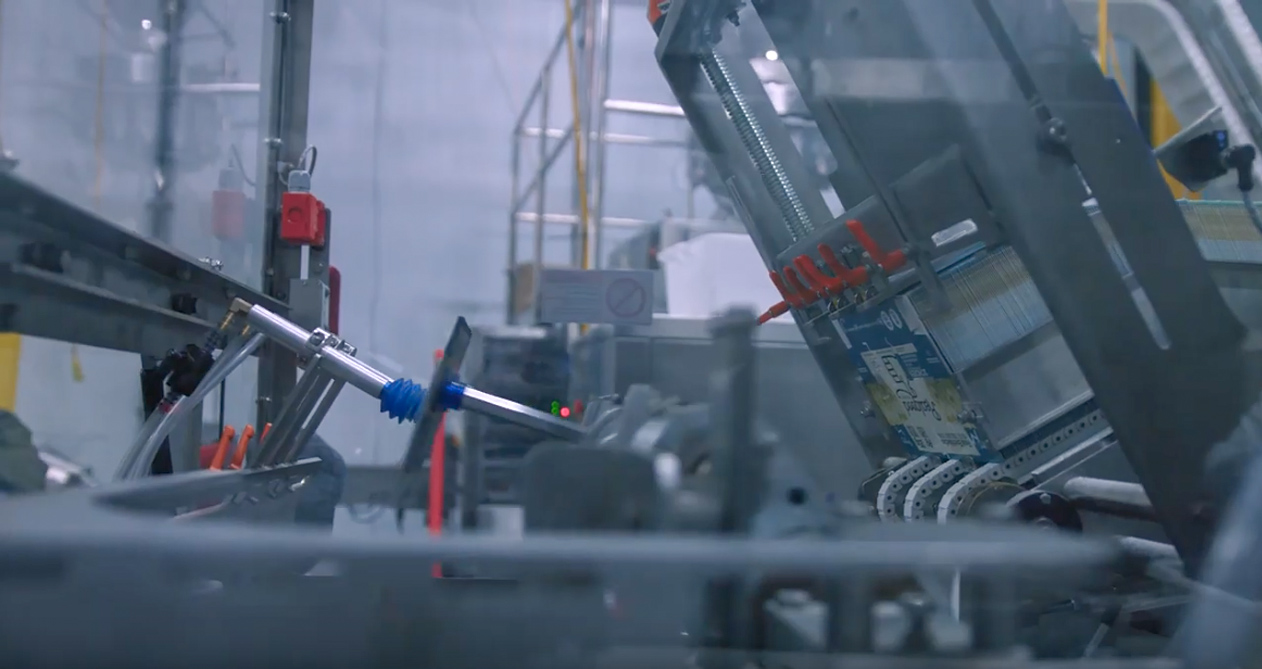

Sallyport Commercial Finance is an independently owned and operated specialty finance company focused on providing entrepreneurs with working capital solutions for small to medium sized businesses, to help drive growth and achieve business hopes and dreams. The senior management team have over 50 years of collective experience in helping entrepreneurs grow their businesses, both in the US and Europe, by turning their invoices and assets into cash. Sallyport Commercial Finance offers a full suite of factoring and asset-based products including Accounts Receivable Finance, Purchase Order Finance, Equipment and Inventory Finance, Cash Flow Loans, and Real Estate Loans. Very experienced in all our industries, our current portfolio includes businesses in Staffing, Energy, Food & Beverage, Apparel, Manufacturing, Service Industry, Transportation, Government Receivables and IT.

Search

News

Helping Talent Thrive with $500K in Fast Funding

Sallyport is proud to announce a $500,000 Accounts Receivable financing facility for a forward-thinking staffing company dedicated to connecting job…

Read MoreQuick Capital for Payroll: $250K to Staffing Firm

Sallyport is proud to partner with a growing IT and Technical Staffing business, providing a $250,000 accounts receivable financing facility…

Read MoreArticles

Ultimate Year End Review for Business Owners

We’ve reached the final few weeks of 2022 and whether December is a busy time or a quieter period for…

Read MoreThe Evolving Nature of Risk Management

The Evolving Nature of Risk Management By Damon Dickens In a rapidly changing world, having confidence in your risk-management…

Read MoreVideos

Popkoffs Client Testimonial

Popkoffs Client Testimonial

View NowAG Machining Client Testimonial

AG Machining Client Testimonial

View Now