Newsroom

$3.5 Million Dollar Credit Facility to an Online Advertising and Publishing Company.

Sallyport Completes $3.5 Million Dollar Credit Facility to an Online Advertising and Publishing Company.

3/12/18 – Sallyport Commercial Finance provides a $3,500,000 Accounts Receivable credit facility for a company that provides their own publishing platform to various multi-national corporations.

“The partnerships we have here at Sallyport Commercial Finance is the keystone to our success. Working with a high caliber turnaround specialist, we were able to seamlessly transition the client from their incumbent bank to Sallyport’s more flexible funding solutions to create greater availability,” says Matt Tobin, VP of Business Development.

Sallyport is excited to provide the additional funding needed to ensure continued growth and expansion of their innovative publishing platform worldwide.

Sallyport Commercial Finance is an independently owned and operated specialty finance company focused on providing entrepreneurs with working capital solutions for small to medium sized businesses, to help drive growth and achieve business hopes and dreams. The senior management team have over 50 years of collective experience in helping entrepreneurs grow their businesses, both in the US and Europe, by turning their invoices and assets into cash. Sallyport Commercial Finance offers a full suite of factoring and asset-based products including Accounts Receivable Finance, Purchase Order Finance, Equipment and Inventory Finance, Cash Flow Loans, and Real Estate Loans. Very experienced in all our industries, our current portfolio includes businesses in Staffing, Energy, Food & Beverage, Apparel, Manufacturing, Service Industry, Transportation, Government Receivables and IT.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

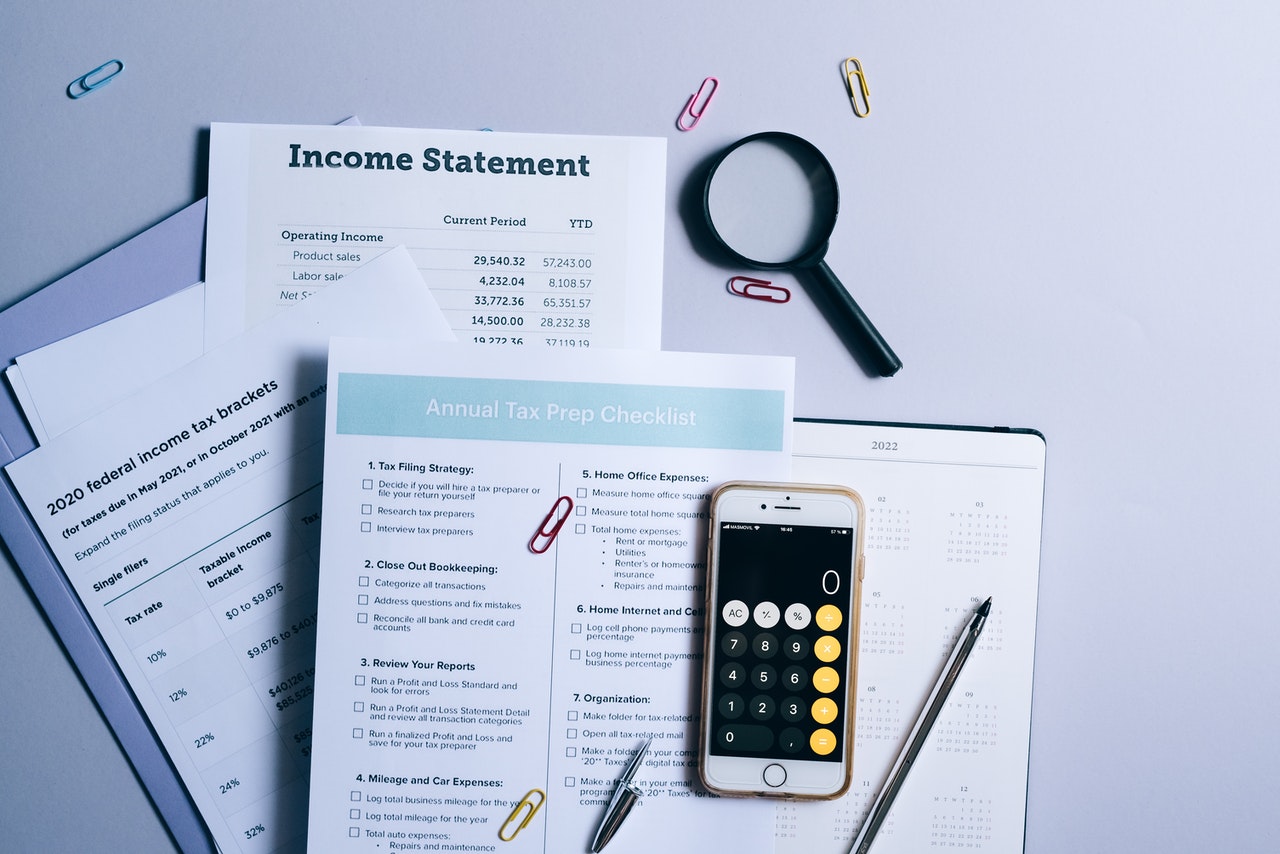

2021 Year-End Financial Checklist for Small Business

Business owners are busy all year round but as the holiday season approaches, things reach a new level of hectic.…

Read More2025 Outlook: What’s in Store for North American SMEs?

Now 2025 is in full swing, the North American business landscape is poised for significant change, presenting both challenges and…

Read MoreVideos