Articles & Videos

5 Ways to Save Money with Full Service Factoring

The primary benefit of invoice factoring for businesses is no doubt quick and easy access to working capital. This capital enhances cash flow and can be used for pretty much whichever purpose the business sees fit. For smaller companies or startups without access to conventional lending, that’s one big reason to use factoring services; another big reason would be that full service factoring companies actually offer a multitude of other services at no additional cost that can actually save your business time and money.

What’s a Full Service Factoring Company?

A full service factoring company goes much further than a simple transactional relationship by offering a host of value-added services that can free-up your time as a busy business owner and also have the potential to save money, boost cash flow even further and mitigate risk in an organization. Here are some of the services a full service factoring company may offer;

1. Credit Analysis

Credit analysis is a very specialized role concerned with all aspects of a business’ financial risk profile. When you use invoice factoring services, their analysts can undertake the background research and perform due diligence on new customer credit requests, changes to credit limits and make recommendations on improvements to business protocols to best protect your interests.

2. Risk Management

A risk manager takes credit analysis to another level and an experienced professional in this area can mitigate future risk for businesses through the thorough identification of financial and other risks which may result in losses. Risk managers are well adept at gathering and analyzing complex financial data with regards to a client’s income, debt and assets and making recommendations which protect against identified risks before they become an issue.

3. Professional Accounts Receivable Management

Accounts receivable usually make up the majority of a company’s available working capital so it’s vital to have invoices paid on time to maintain positive cash flow. Valuable hours can be spent chasing customers for payment of unpaid invoices however and this is something a factoring provider can manage for you. Small business owners don’t usually have a lot of time on their hands to consistently send out payment reminders or keep on top of A/R aging reports so having experienced A/R management on your side to implement payment processes and communicate professionally with your clients is just like having an extension of your own team.

4. Treasury Operations Support

Treasury operations have a more holistic view of a company’s finance. Treasury managers are responsible for overseeing cash flow and revenue, optimizing liquidity and also mitigating risk to the organization on a number of levels; operational, financial and reputational. Treasury managers invariably are highly qualified financial planners and have the excellent leadership and communication skills required to devise long-term financial strategy for a business.

5. Customer Service Support

Factoring companies are used to dealing with the everyday service and support queries generated in the ordinary process of doing business with clients and suppliers and a good factoring company will already have the personnel to help clients manage this. For a small business, having someone dedicated to this area can result in incremental revenue opportunities, customer evangelism and improved brand awareness and reputation, which again, can produce increased profits.

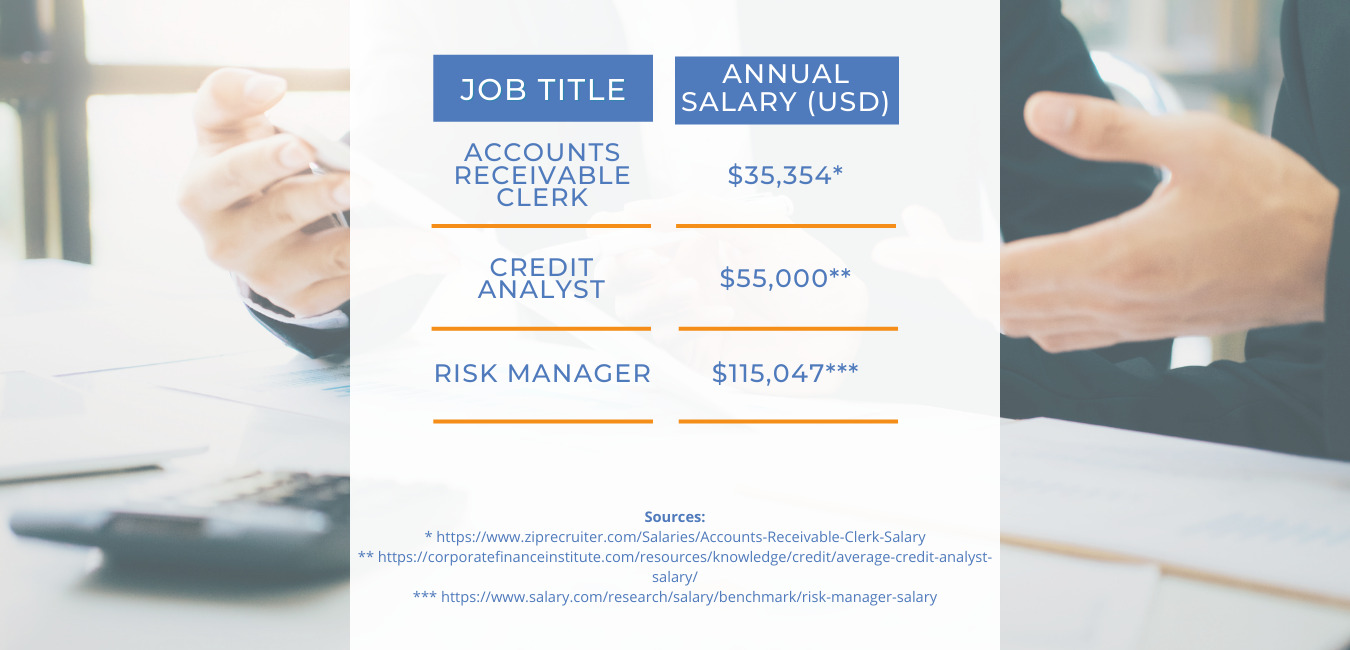

Consider Average Salaries for Finance Professionals

If you were to add full-time members to your finance team to cover off some of these responsibilities, these are just a few of the average salaries you could reasonably be expected to pay…

Leverage Our Industry Expertise

A small, new or growing business may not be able to justify the expense of the additional headcounts in these areas but this is where the expertise of the best factoring companies comes into its own. Sallyport Commercial Finance have over 150 years combined experience employing some of the best financial specialists in the industry whose knowledge is there to tap into when you use our services.

When you’re thinking about how to choose a factoring company, consider whether you could utilize any of these services to enhance your business and save you time and money while your business grows, safe in the knowledge that your accounts receivables and factoring provider are working hard for your success.

Reach out today to find out what’s included with our full service invoice factoring services.

Search

News

$1M Funding Fuels Agri-Business Growth Across Borders

Sallyport is pleased to announce a new partnership with a Canadian agriculture business, providing a $1,000,000 Accounts Receivable facility to…

Read MoreFueling EdTech Growth with $5.5M in Tailored Financing

Sallyport is excited to support a forward-thinking education technology company with a $5.5M combined Asset-Based Lending facility, including Accounts Receivable…

Read MoreArticles

Where to Find Funding for Dropshipping Businesses

Dropshipping can be a very low-cost way to start an e-commerce business. You can think of it as using a…

Read MoreUnderstanding Business Acquisition Financing

At the simplest level, business acquisition financing is the capital that needs to be obtained for a company to purchase…

Read MoreVideos

American Business Women’s Day

Sallyport Commercial Finance Celebrates American Business Women’s Day

View NowPopkoffs Client Testimonial

Popkoffs Client Testimonial

View Now